Summary

In many online advertisement (ad) exchanges, ad slots are each sold via a separate second-price auction. This paper considers the bidder's problem of maximizing the value of ads they purchase in these auctions, subject to budget constraints. This 'second-price knapsack' problem presents challenges when devising a bidding strategy because of the uncertain resource consumption: bidders win if they bid the highest amount, but pay the second-highest bid, unknown a priori. This is in contrast to the traditional online knapsack problem, where posted prices are revealed when ads arrive, and for which there exists a rich literature of primal and dual algorithms. The main results of this paper establish general methods for adapting these primal and dual online knapsack selection algorithms to the second-price knapsack problem, where the prices are revealed only after bidding. In particular, a methodology is provided for converting deterministic and randomized knapsack selection algorithms into second-price knapsack bidding strategies, that purchase ads through an equivalent set of criteria and thereby achieve the same competitive guarantees. This shows a connection between the traditional knapsack selection algorithm and second-price auction bidding algorithms, that has not previously been leveraged. Empirical analysis on real ad exchange data verifies the usefulness of this method, and gives examples where it can outperform state-of-the-art techniques.

AI Key Findings

Generated Sep 07, 2025

Methodology

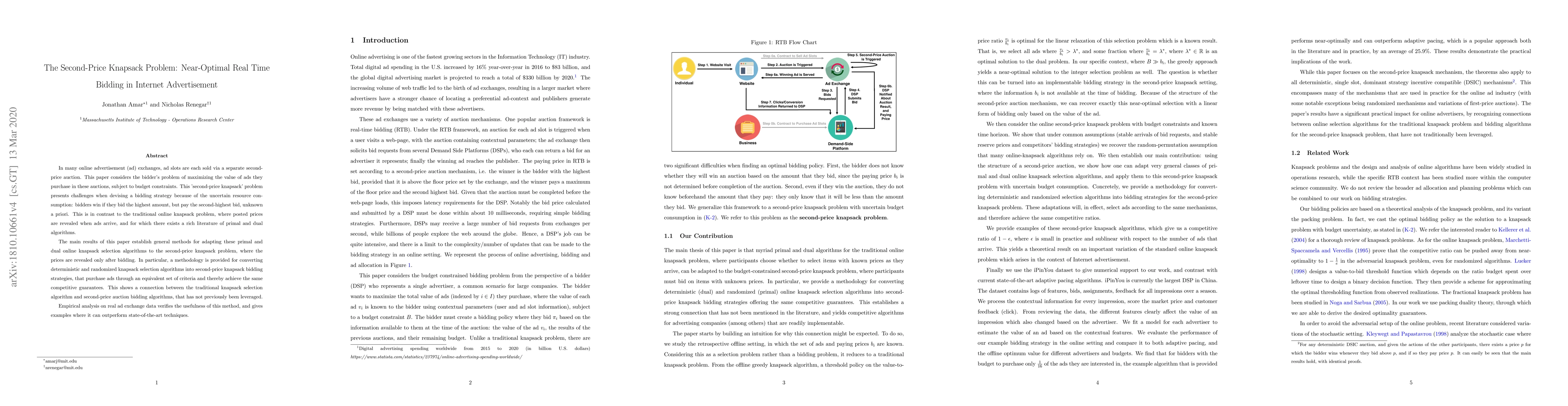

The paper establishes a connection between online knapsack selection algorithms with known prices and second-price knapsack bidding algorithms with unknown prices, adapting primal and dual online knapsack algorithms to the second-price setting, ensuring the same competitive guarantees.

Key Results

- Methods for converting deterministic and randomized knapsack selection algorithms into second-price knapsack bidding strategies.

- Empirical analysis on real ad exchange data showing the effectiveness of the proposed method compared to state-of-the-art techniques.

- Achieving a competitive ratio of 1−6ε in the random permutation setting using an adapted one-shot learning algorithm.

- A randomized algorithm with a competitive ratio of 1−45√bmax/B in the stable setting.

Significance

This research provides competitive and readily implementable algorithms for advertising companies, bridging a gap between online knapsack algorithms and second-price knapsack bidding algorithms, which could lead to improved real-time bidding strategies in Internet advertising exchanges.

Technical Contribution

The paper introduces methodologies to adapt primal and dual online knapsack algorithms to the second-price knapsack problem, ensuring the same competitive guarantees and providing examples of online knapsack algorithms adapted to the second-price setting.

Novelty

The novelty lies in leveraging the connection between traditional knapsack selection algorithms and second-price auction bidding algorithms, which has not been previously exploited, and in providing practical, near-optimal bidding strategies for real-time ad bidding.

Limitations

- Empirical evaluation is based on a single dataset (iPinYou) and may not generalize to all ad exchanges.

- The study assumes a simplified model of second-price auctions without considering complexities like reserve prices or shading.

- The analysis does not account for potential changes in competitor behavior or market dynamics over time.

Future Work

- Investigate the applicability of the proposed methods to other auction formats and datasets.

- Explore the impact of reserve prices and shading in second-price auctions on bidding strategies.

- Develop adaptive algorithms that can respond to long-term market changes while avoiding the pitfalls of adaptive pacing.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAuto-bidding in real-time auctions via Oracle Imitation Learning (OIL)

Zhao Wang, Briti Gangopadhyay, Shingo Takamatsu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)