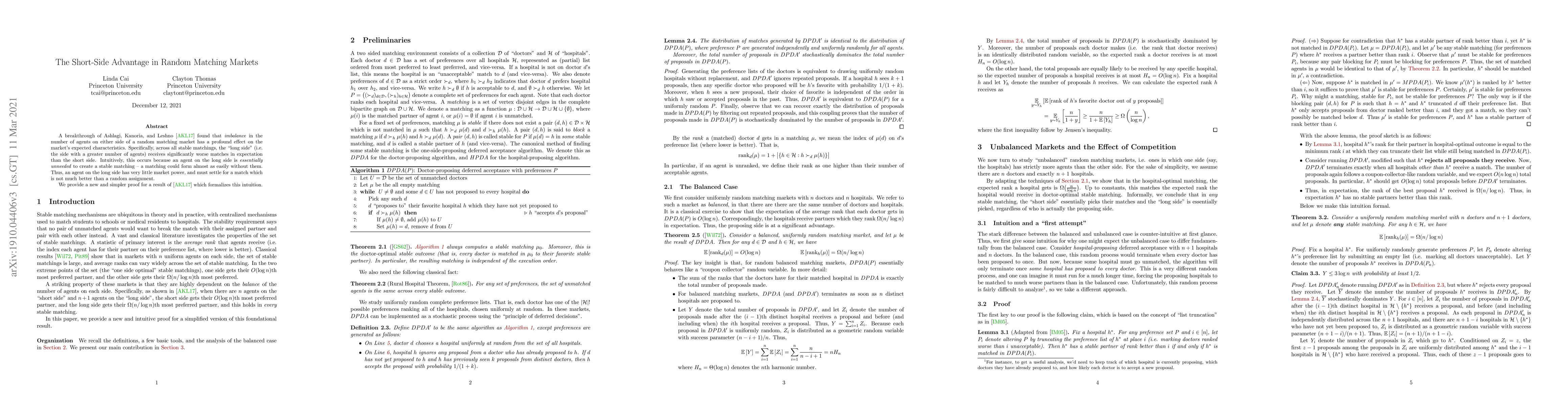

Summary

A breakthrough of Ashlagi, Kanoria, and Leshno [AKL17] found that imbalance in the number of agents on either side of a random matching market has a profound effect on the market's expected characteristics. Specifically, across all stable matchings, the "long side" (i.e. the side with a greater number of agents) receives significantly worse matches in expectation than the short side. Intuitively, this occurs because an agent on the long side is essentially unneeded to create a stable matching -- a matching could form almost as easily without them. Thus, an agent on the long side has very little market power, and must settle for a match which is not much better than a random assignment. We provide a new and simpler proof for a result of [AKL17] which formalizes this intuition.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Direct Proof of the Short-Side Advantage in Random Matching Markets

Adrian Vetta, Pawel Pralat, Simon Mauras

From signaling to interviews in random matching markets

Amin Saberi, Itai Ashlagi, Maxwell Allman et al.

The Competition for Partners in Matching Markets

Yash Kanoria, Seungki Min, Pengyu Qian

Unbalanced Random Matching Markets with Partial Preferences

Aditya Potukuchi, Shikha Singh

| Title | Authors | Year | Actions |

|---|

Comments (0)