Summary

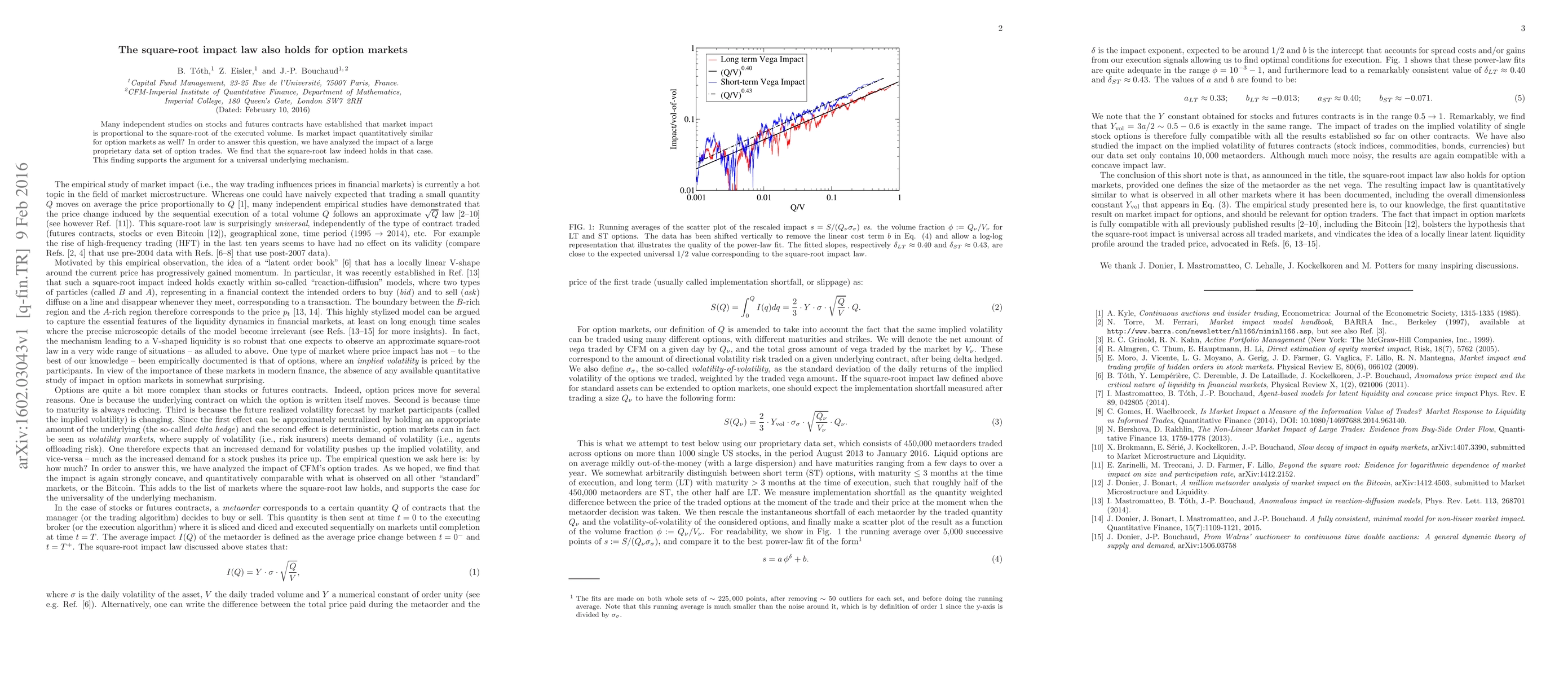

Many independent studies on stocks and futures contracts have established that market impact is proportional to the square-root of the executed volume. Is market impact quantitatively similar for option markets as well? In order to answer this question, we have analyzed the impact of a large proprietary data set of option trades. We find that the square-root law indeed holds in that case. This finding supports the argument for a universal underlying mechanism.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe "double" square-root law: Evidence for the mechanical origin of market impact using Tokyo Stock Exchange data

Jean-Philippe Bouchaud, Grégoire Loeper, Kiyoshi Kanazawa et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)