Summary

We study the stochastic solution to a Cauchy problem for a degenerate parabolic equation arising from option pricing. When the diffusion coefficient of the underlying price process is locally H\"older continuous with exponent $\delta\in (0, 1]$, the stochastic solution, which represents the price of a European option, is shown to be a classical solution to the Cauchy problem. This improves the standard requirement $\delta\ge 1/2$. Uniqueness results, including a Feynman-Kac formula and a comparison theorem, are established without assuming the usual linear growth condition on the diffusion coefficient. When the stochastic solution is not smooth, it is characterized as the limit of an approximating smooth stochastic solutions. In deriving the main results, we discover a new, probabilistic proof of Kotani's criterion for martingality of a one-dimensional diffusion in natural scale.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

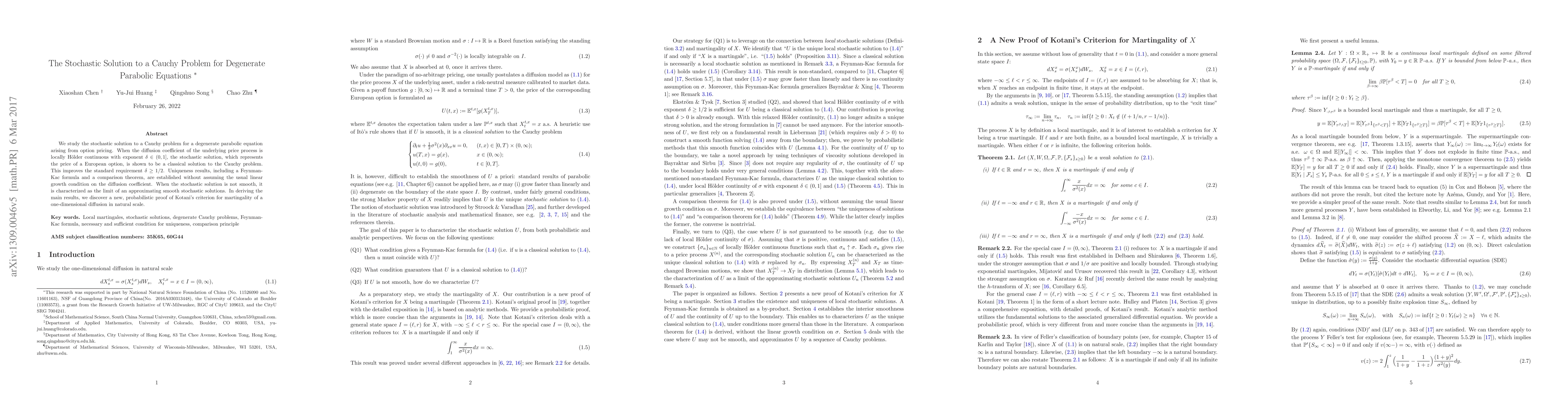

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Cauchy problem for doubly degenerate parabolic equations with weights

Daniele Andreucci, Anatoli F. Tedeev

| Title | Authors | Year | Actions |

|---|

Comments (0)