Summary

In this paper, we explore several Fatou-type properties of risk measures. The paper continues to reveal that the strong Fatou property, which was introduced in [17], seems to be most suitable to ensure nice dual representations of risk measures. Our main result asserts that every quasiconvex law-invariant functional on a rearrangement invariant space $\mathcal{X}$ with the strong Fatou property is $\sigma(\mathcal{X},L^\infty)$ lower semicontinuous and that the converse is true on a wide range of rearrangement invariant spaces. We also study inf-convolutions of law-invariant or surplus-invariant risk measures that preserve the (strong) Fatou property.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

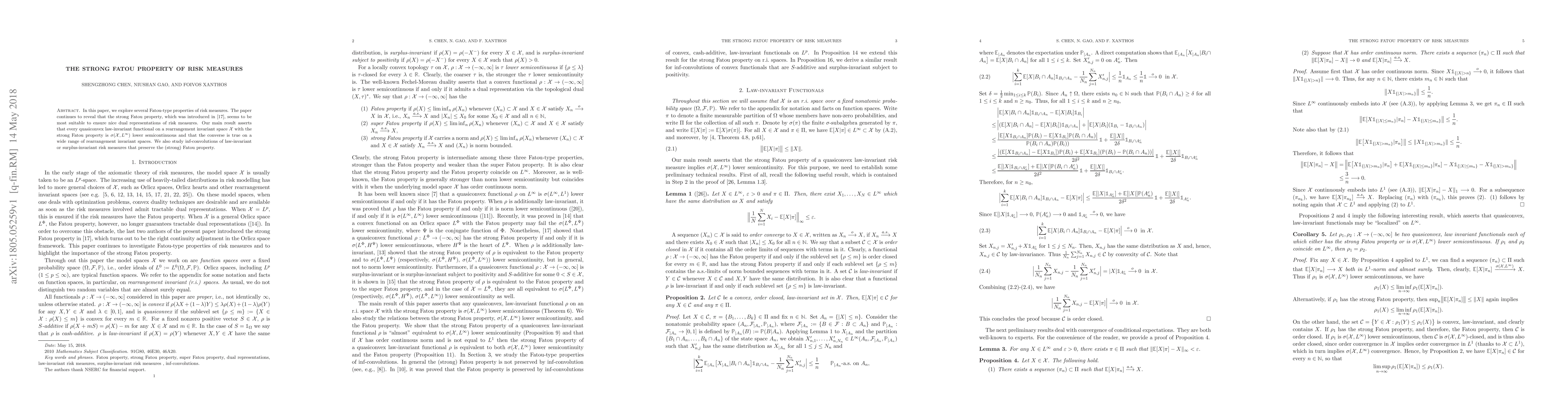

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAutomatic Fatou Property of Law-invariant Risk Measures

Lei Li, Niushan Gao, Shengzhong Chen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)