Authors

Summary

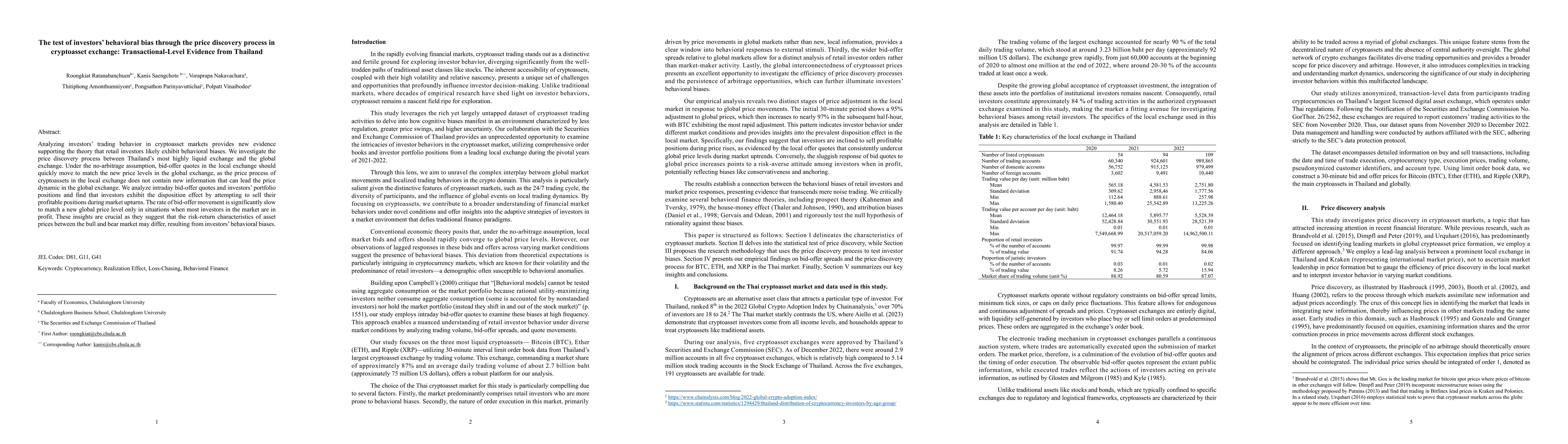

Analyzing investors' trading behavior in cryptoasset markets provides new evidence supporting the theory that retail investors likely exhibit behavioral biases. We investigate the price discovery process between Thailand's most highly liquid exchange and the global exchange. Under the no-arbitrage assumption, bid-offer quotes in the local exchange should quickly move to match the new price levels in the global exchange, as the price process of cryptoassets in the local exchange does not contain new information that can lead the price dynamic in the global exchange. We analyze intraday bid-offer quotes and investors' portfolio positions and find that investors exhibit the disposition effect by attempting to sell their profitable positions during market upturns. The rate of bid-offer movement is significantly slow to match a new global price level only in situations when most investors in the market are in profit. These insights are crucial as they suggest that the risk-return characteristics of asset prices between the bull and bear market may differ, resulting from investors' behavioral biases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExchange Rate Pass-Through and Data Frequency: Firm-Level Evidence from Bangladesh

Md Deluair Hossen

Nash equilibria for relative investors with (non)linear price impact

Nicole Bäuerle, Tamara Göll

No citations found for this paper.

Comments (0)