Summary

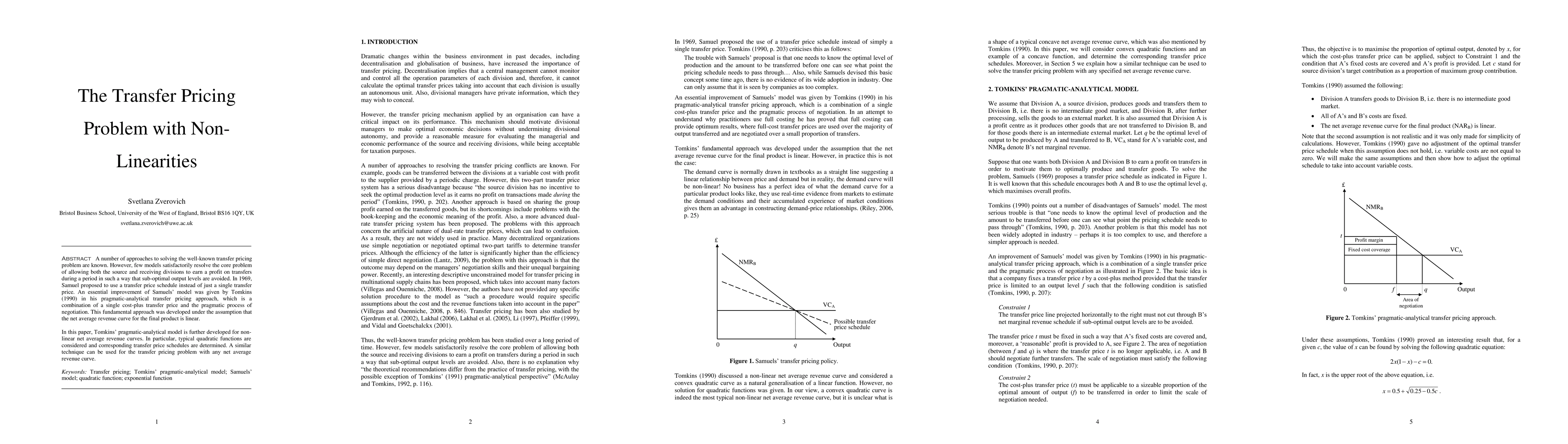

A number of approaches to solving the well-known transfer pricing problem are known. However, few models satisfactorily resolve the core problem of allowing both the source and receiving divisions to earn a profit on transfers during a period in such a way that sub-optimal output levels are avoided. In 1969, Samuel proposed to use a transfer price schedule instead of just a single transfer price. An essential improvement of Samuels' model was given by Tomkins (1990) in his pragmatic-analytical transfer pricing approach, which is a combination of a single cost-plus transfer price and the pragmatic process of negotiation. This fundamental approach was developed under the assumption that the net average revenue curve for the final product is linear. In this paper, Tomkins' pragmatic-analytical model is further developed for non-linear net average revenue curves. In particular, typical quadratic functions are considered and corresponding transfer price schedules are determined. A similar technique can be used for the transfer pricing problem with any net average revenue curve.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)