Authors

Summary

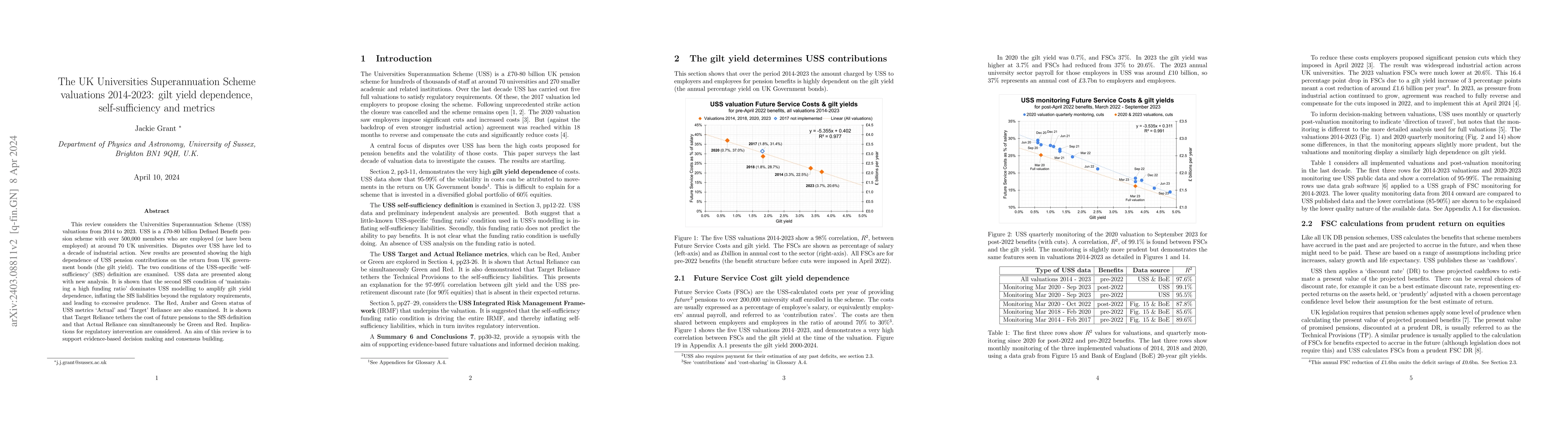

This review considers the Universities Superannuation Scheme (USS) valuations from 2014 to 2023. USS is a 70-80 billion GBP Defined Benefit pension scheme with over 500,000 members who are employed (or have been employed) at around 70 UK universities. Disputes over USS have led to a decade of industrial action. New results are presented showing the high dependence of USS pension contributions on the return from UK government bonds (the gilt yield). The two conditions of the USS-specific 'self-sufficiency' (SfS) definition are examined. USS data are presented along with new analysis. It is shown that the second SfS condition of 'maintaining a high funding ratio' dominates USS modelling to amplify gilt yield dependence, inflating the SfS liabilities beyond the regulatory requirements, and leading to excessive prudence. The Red, Amber and Green status of USS metrics 'Actual' and 'Target' Reliance are also examined. It is shown that Target Reliance tethers the cost of future pensions to the SfS definition and that Actual Reliance can simultaneously be Green and Red. Implications for regulatory intervention are considered. An aim of this review is to support evidence-based decision making and consensus building.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersAchieving equitable access to health technologies during a pandemic: Lessons learned from UK universities' technology transfer practices & policies 2019-2023.

Eni-Olotu, Ayolola, Hotchkin, Rebecca, McCormick, Rachel et al.

No citations found for this paper.

Comments (0)