Summary

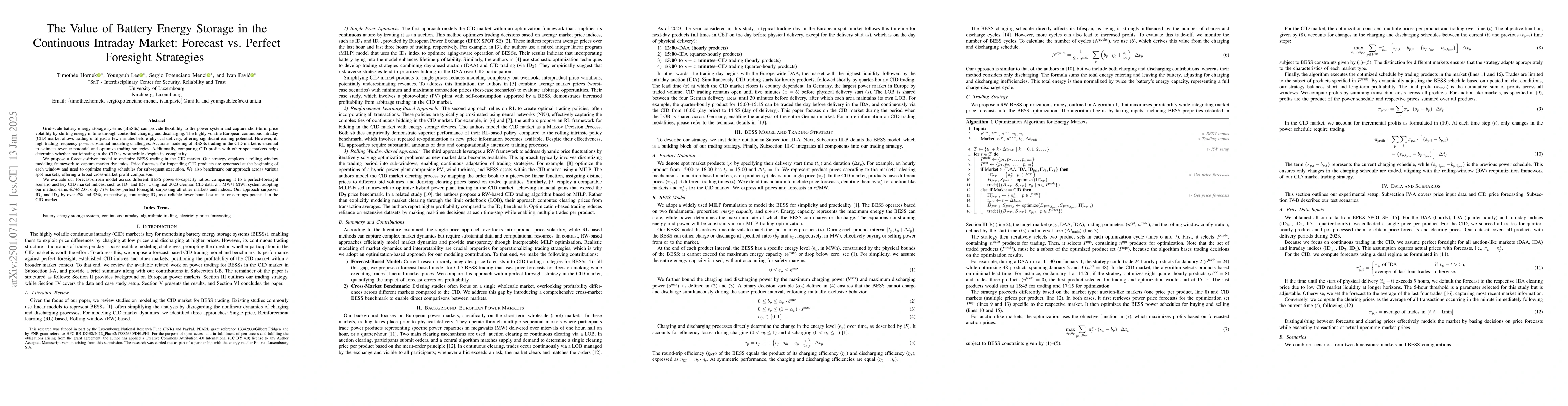

Grid-scale battery energy storage systems (BESSs) can provide flexibility to the power system and capture shortterm price volatility by shifting energy in time through controlled charging and discharging. The highly volatile European continuous intraday (CID) market allows trading until just a few minutes before physical delivery, offering significant earning potential. However, its high trading frequency poses substantial modeling challenges. Accurate modeling of BESSs trading in the CID market is essential to estimate revenue potential and optimize trading strategies. Additionally, comparing CID profits with other spot markets helps determine whether participating in the CID is worthwhile despite its complexity. We propose a forecast-driven model to optimize BESS trading in the CID market. Our strategy employs a rolling window modeling framework to capture market dynamics. Price forecasts for impending CID products are generated at the beginning of each window and used to optimize trading schedules for subsequent execution. We also benchmark our approach across various spot markets, offering a broad cross-market profit comparison. We evaluate our forecast-driven model across different BESS power-to-capacity ratios, comparing it to a perfect-foresight scenario and key CID market indices, such as ID1 and ID3. Using real 2023 German CID data, a 1 MW/1 MWh system adopting our method earns EUR 146 237, only 11% below perfect foresight, surpassing all other markets and indices. Our approach surpasses ID1 and ID3 by over 4% and 32%, respectively, confirming ID1 as a reliable lower-bound estimate for earnings potential in the CID market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersMaximizing Battery Storage Profits via High-Frequency Intraday Trading

Thorsten Staake, Nils Löhndorf, David Wozabal et al.

Optimal Control of a Battery Storage On the Energy Market

Stephan Schlüter, Abhinav Das, Mathew Davison

Rolling intrinsic for battery valuation in day-ahead and intraday markets

Daniel Oeltz, Tobias Pfingsten

Coordinated Trading Strategies for Battery Storage in Reserve and Spot Markets

Paul E. Seifert, Emil Kraft, Steffen Bakker et al.

No citations found for this paper.

Comments (0)