Summary

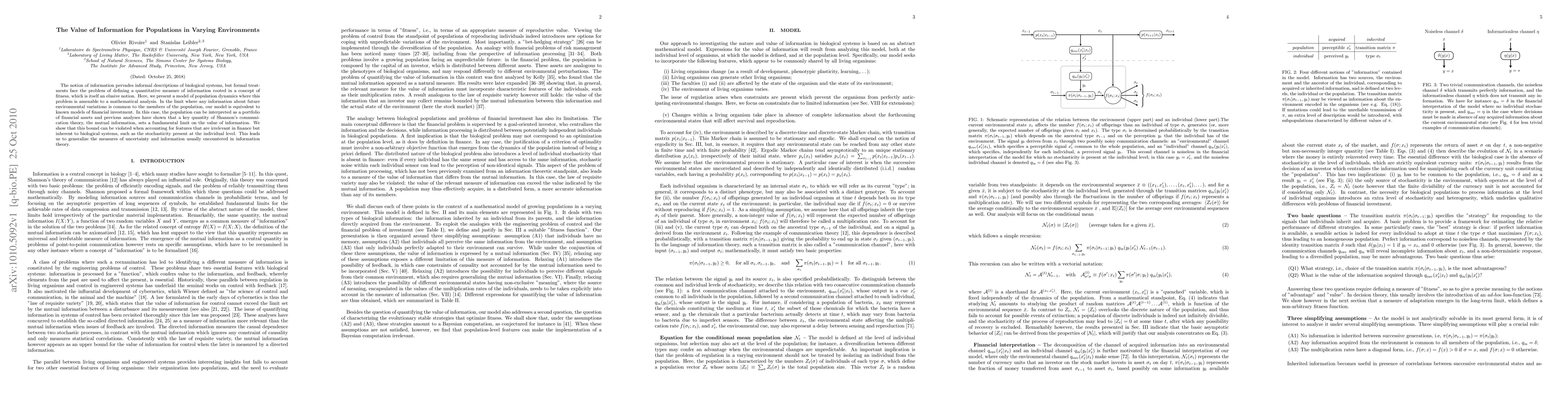

The notion of information pervades informal descriptions of biological systems, but formal treatments face the problem of defining a quantitative measure of information rooted in a concept of fitness, which is itself an elusive notion. Here, we present a model of population dynamics where this problem is amenable to a mathematical analysis. In the limit where any information about future environmental variations is common to the members of the population, our model is equivalent to known models of financial investment. In this case, the population can be interpreted as a portfolio of financial assets and previous analyses have shown that a key quantity of Shannon's communication theory, the mutual information, sets a fundamental limit on the value of information. We show that this bound can be violated when accounting for features that are irrelevant in finance but inherent to biological systems, such as the stochasticity present at the individual level. This leads us to generalize the measures of uncertainty and information usually encountered in information theory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe value of internal memory for population growth in varying environments

BingKan Xue, Leo Law

Mutual information in changing environments: non-linear interactions, out-of-equilibrium systems, and continuously-varying diffusivities

Daniel Maria Busiello, Giorgio Nicoletti

| Title | Authors | Year | Actions |

|---|

Comments (0)