Summary

We provide analytical tools for pricing power options with exotic features (capped or log payoffs, gap options ...) in the framework of exponential L\'evy models driven by one-sided stable or tempered stable processes. Pricing formulas take the form of fast converging series of powers of the log-forward moneyness and of the time-to-maturity; these series are obtained via a factorized integral representation in the Mellin space evaluated by means of residues in $\mathbb{C}$ or $\mathbb{C}^2$. Comparisons with numerical methods and efficiency tests are also discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

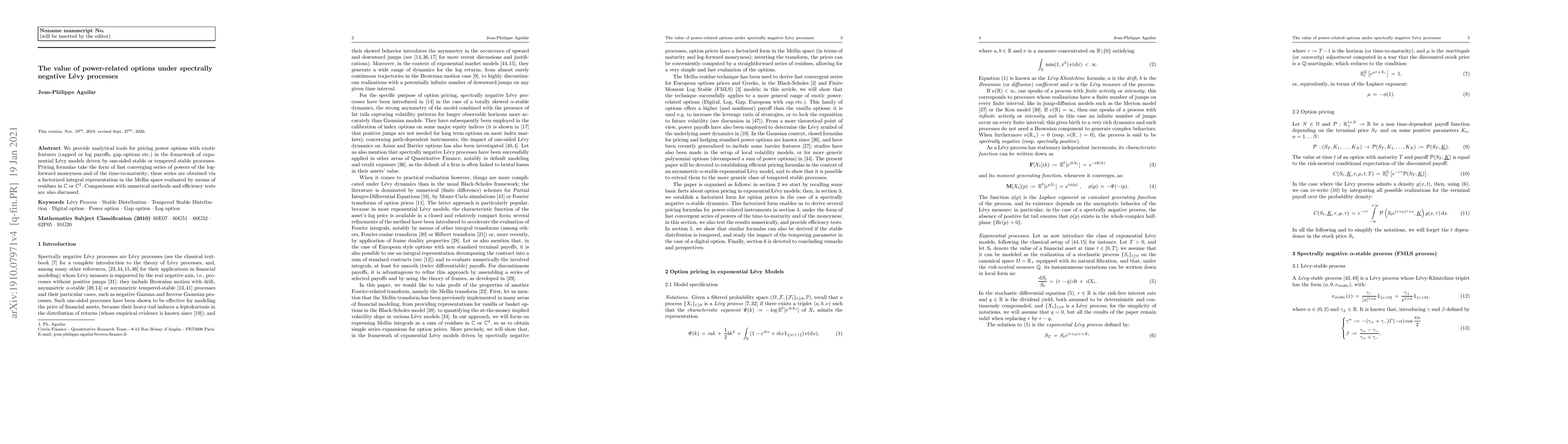

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)