Summary

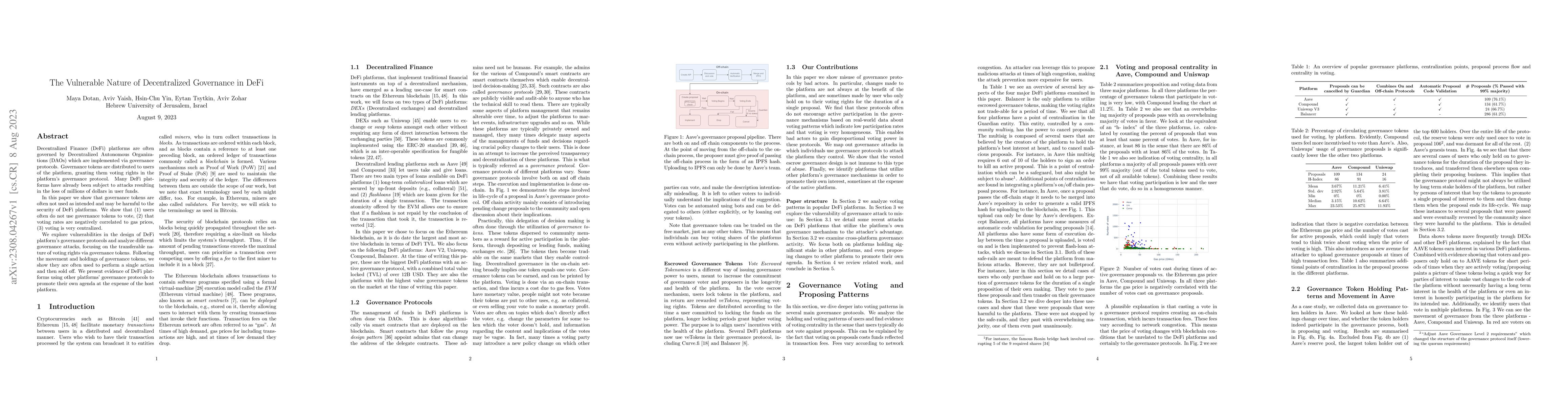

Decentralized Finance (DeFi) platforms are often governed by Decentralized Autonomous Organizations (DAOs) which are implemented via governance protocols. Governance tokens are distributed to users of the platform, granting them voting rights in the platform's governance protocol. Many DeFi platforms have already been subject to attacks resulting in the loss of millions of dollars in user funds. In this paper we show that governance tokens are often not used as intended and may be harmful to the security of DeFi platforms. We show that (1) users often do not use governance tokens to vote, (2) that voting rates are negatively correlated to gas prices, (3) voting is very centralized. We explore vulnerabilities in the design of DeFi platform's governance protocols and analyze different governance attacks, focusing on the transferable nature of voting rights via governance tokens. Following the movement and holdings of governance tokens, we show they are often used to perform a single action and then sold off. We present evidence of DeFi platforms using other platforms' governance protocols to promote their own agenda at the expense of the host platform.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVote Delegation in DeFi Governance

Daniel Liebau, Dion Bongaerts, Thomas Lambert et al.

A Comprehensive Study of Governance Issues in Decentralized Finance Applications

Xiaofei Xie, Ye Liu, Yi Li et al.

Decentralized Finance: Protocols, Risks, and Governance

Garud Iyengar, Agostino Capponi, Jay Sethuraman

| Title | Authors | Year | Actions |

|---|

Comments (0)