Summary

This paper is concerned with the nonlinear filtering problem for a general Markovian partially observed system (X,Y), whose dynamics is modeled by correlated jump-diffusions having common jump times. At any time t, the sigma-algebra generated by the observation process Y provides all the available information about the signal X. The central goal of stochastic filtering is to characterize the filter which is the conditional distribution of X, given the observed data. It has been proved in Ceci-Colaneri (2012) that the filter is the unique probability measure-valued process satisfying a nonlinear stochastic equation, the so-called Kushner-Stratonovich equation (KS-equation). In this paper the aim is to describe the filter in terms of the unnormalized filter, which is solution to a linear stochastic differential equation, called the Zakai equation. We prove equivalence between strong uniqueness for the solution to the Kushner Stratonovich equation and strong uniqueness for the solution to the Zakai one and, as a consequence, we deduce pathwise uniqueness for the solutions to the Zakai equation by applying the Filtered Martingale Problem approach (Kurtz-Ocone (1988), Kurtz-Nappo (2011), Ceci-Colaneri (2012)). To conclude, we discuss some particular cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

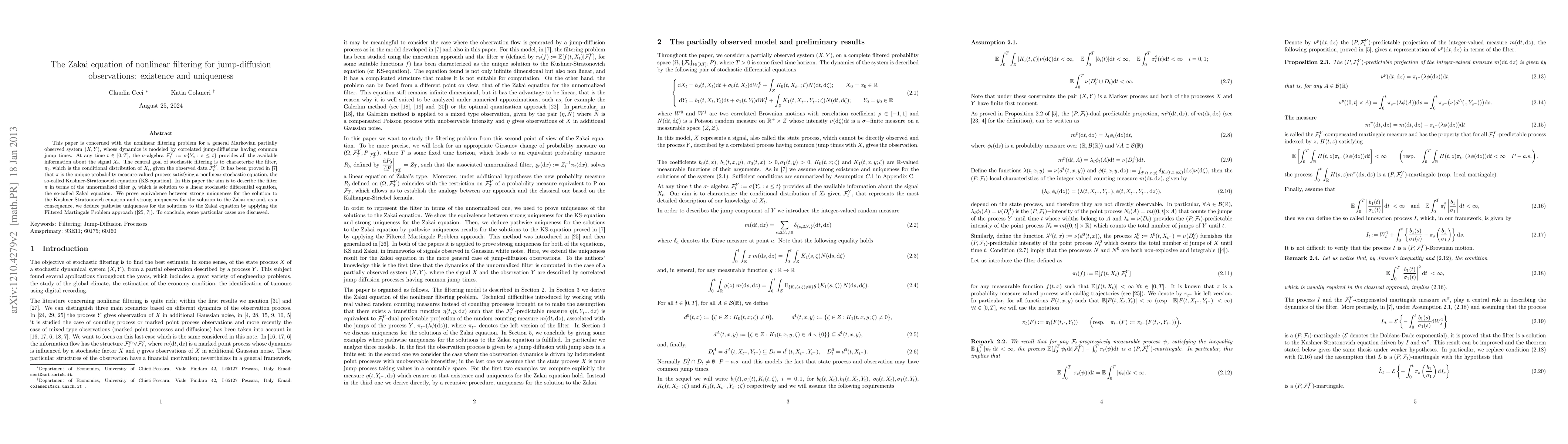

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUniqueness and superposition of the space-distribution dependent Zakai equations

Huijie Qiao, Meiqi Liu

| Title | Authors | Year | Actions |

|---|

Comments (0)