Summary

In this paper we propose and analyse a method for estimating three quantities related to an Asian option: the fair price, the cumulative distribution function, and the probability density. The method involves preintegration with respect to one well chosen integration variable to obtain a smooth function of the remaining variables, followed by the application of a tailored lattice Quasi-Monte Carlo rule to integrate over the remaining variables.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

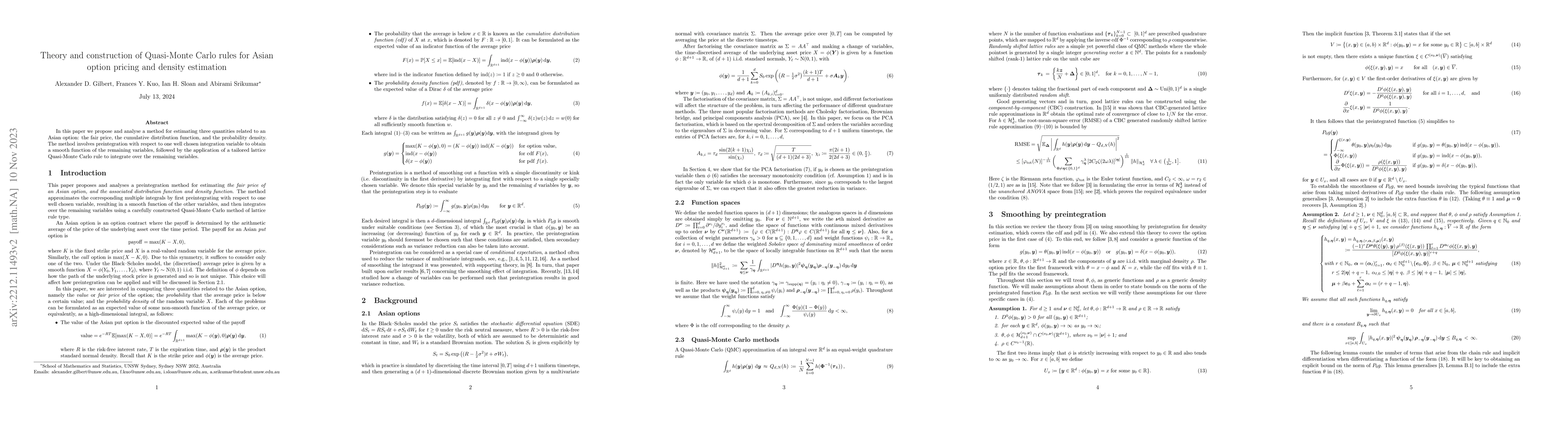

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDenoised Monte Carlo for option pricing and Greeks estimation

Andrzej Daniluk, Evgeny Lakshtanov, Rafal Muchorski

| Title | Authors | Year | Actions |

|---|

Comments (0)