Summary

A term structure model in which the short rate is zero is developed as a candidate for a theory of cryptocurrency interest rates. The price processes of crypto discount bonds are worked out, along with expressions for the instantaneous forward rates and the prices of interest-rate derivatives. The model admits functional degrees of freedom that can be calibrated to the initial yield curve and other market data. Our analysis suggests that strict local martingales can be used for modelling the pricing kernels associated with virtual currencies based on distributed ledger technologies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

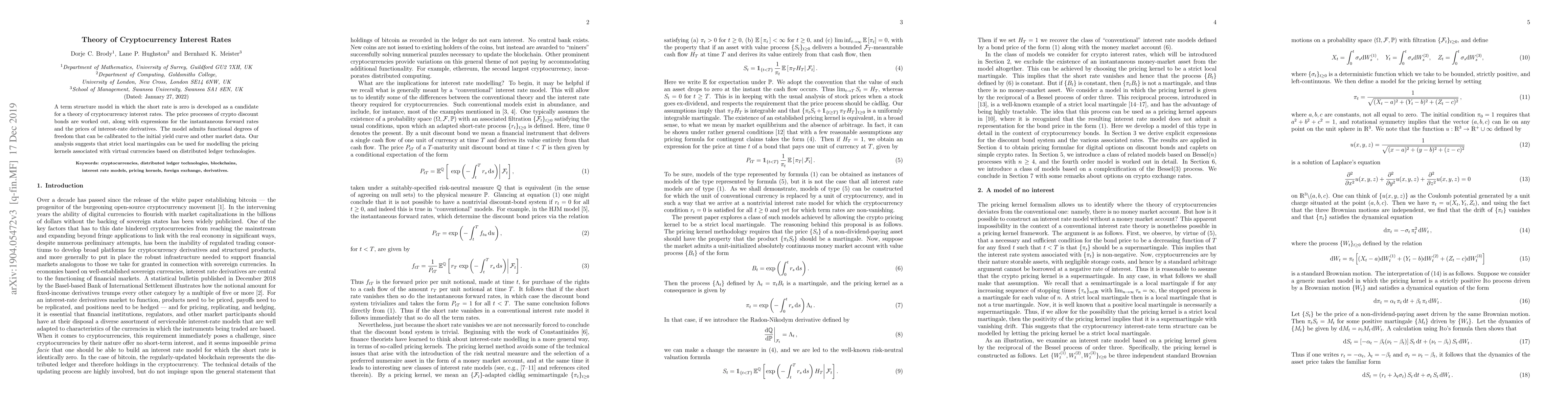

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)