Summary

We develop a theory of evolutionary spectra for heteroskedasticity and autocorrelation robust (HAR) inference when the data may not satisfy second-order stationarity. Nonstationarity is a common feature of economic time series which may arise either from parameter variation or model misspecification. In such a context, the theories that support HAR inference are either not applicable or do not provide accurate approximations. HAR tests standardized by existing long-run variance estimators then may display size distortions and little or no power. This issue can be more severe for methods that use long bandwidths (i.e., fixed-b HAR tests). We introduce a class of nonstationary processes that have a time-varying spectral representation which evolves continuously except at a finite number of time points. We present an extension of the classical heteroskedasticity and autocorrelation consistent (HAC) estimators that applies two smoothing procedures. One is over the lagged autocovariances, akin to classical HAC estimators, and the other is over time. The latter element is important to flexibly account for nonstationarity. We name them double kernel HAC (DK-HAC) estimators. We show the consistency of the estimators and obtain an optimal DK-HAC estimator under the mean squared error (MSE) criterion. Overall, HAR tests standardized by the proposed DK-HAC estimators are competitive with fixed-b HAR tests, when the latter work well, with regards to size control even when there is strong dependence. Notably, in those empirically relevant situations in which previous HAR tests are undersized and have little or no power, the DK-HAC estimator leads to tests that have good size and power.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

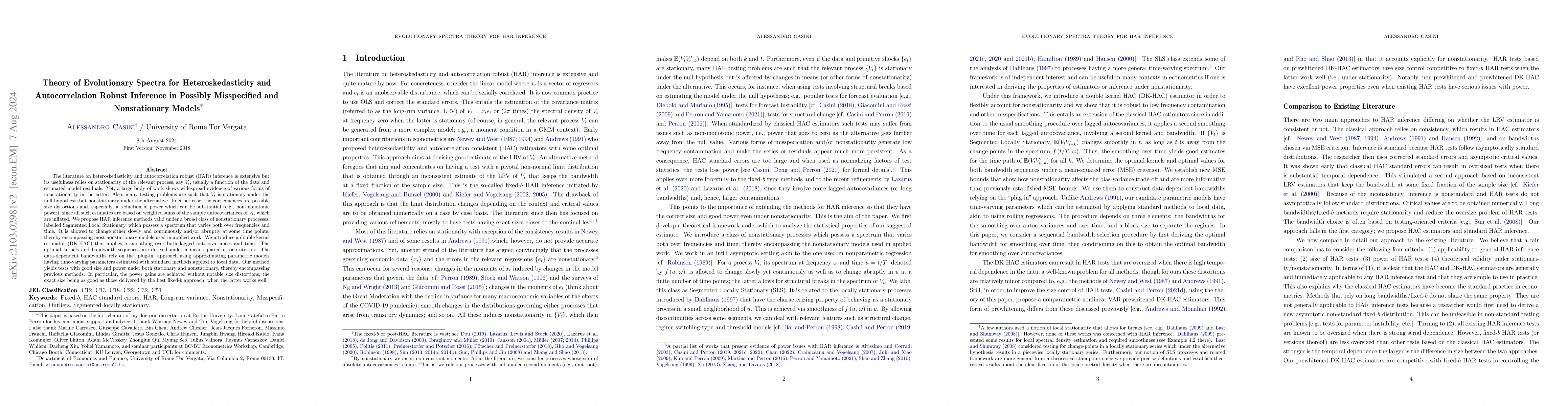

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)