Summary

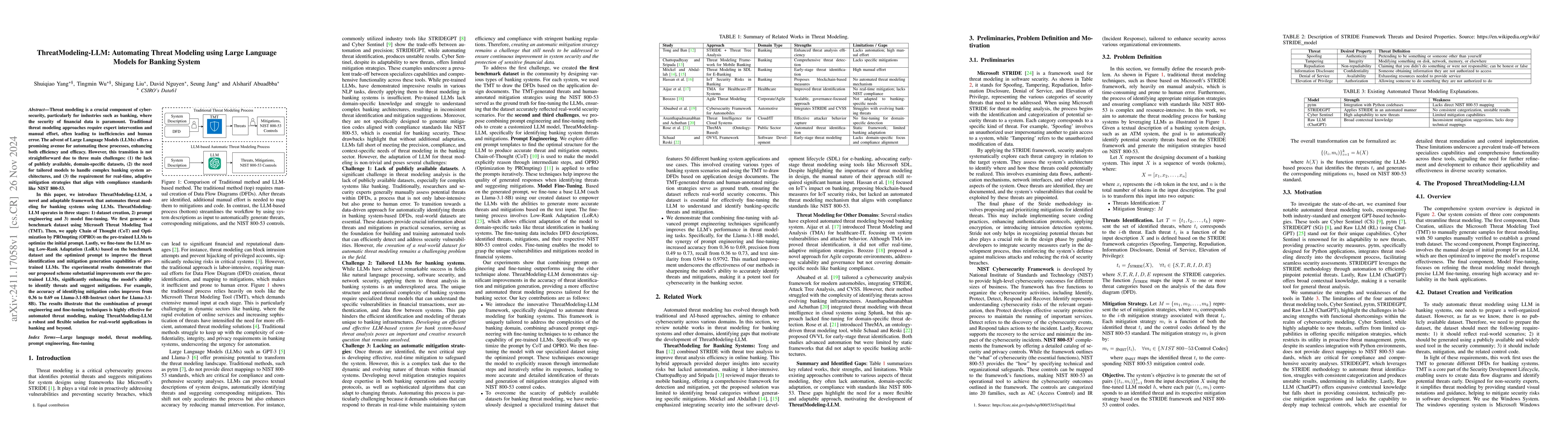

Threat modeling is a crucial component of cybersecurity, particularly for industries such as banking, where the security of financial data is paramount. Traditional threat modeling approaches require expert intervention and manual effort, often leading to inefficiencies and human error. The advent of Large Language Models (LLMs) offers a promising avenue for automating these processes, enhancing both efficiency and efficacy. However, this transition is not straightforward due to three main challenges: (1) the lack of publicly available, domain-specific datasets, (2) the need for tailored models to handle complex banking system architectures, and (3) the requirement for real-time, adaptive mitigation strategies that align with compliance standards like NIST 800-53. In this paper, we introduce ThreatModeling-LLM, a novel and adaptable framework that automates threat modeling for banking systems using LLMs. ThreatModeling-LLM operates in three stages: 1) dataset creation, 2) prompt engineering and 3) model fine-tuning. We first generate a benchmark dataset using Microsoft Threat Modeling Tool (TMT). Then, we apply Chain of Thought (CoT) and Optimization by PROmpting (OPRO) on the pre-trained LLMs to optimize the initial prompt. Lastly, we fine-tune the LLM using Low-Rank Adaptation (LoRA) based on the benchmark dataset and the optimized prompt to improve the threat identification and mitigation generation capabilities of pre-trained LLMs.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research introduces ThreatModeling-LLM, a framework automating threat modeling for banking systems using Large Language Models (LLMs). It operates in three stages: dataset creation using Microsoft Threat Modeling Tool (TMT), prompt engineering with Chain of Thought (CoT) and Optimization by PROmpting (OPRO), and model fine-tuning with Low-Rank Adaptation (LoRA).

Key Results

- ThreatModeling-LLM outperforms existing automated threat modeling tools in precision, recall, and text similarity.

- Fine-tuning LLMs significantly improves threat identification and mitigation generation capabilities.

- The combined approach of CoT and OPRO in prompt engineering enhances the model's performance in identifying and mitigating threats.

Significance

This research is significant as it automates threat modeling, a crucial yet labor-intensive cybersecurity process, for banking systems, improving efficiency and accuracy while reducing human error.

Technical Contribution

The paper presents a novel framework, ThreatModeling-LLM, which leverages LLMs for automated threat modeling in banking systems, incorporating a three-stage process of dataset creation, prompt engineering, and model fine-tuning.

Novelty

ThreatModeling-LLM differentiates itself by integrating CoT and OPRO in prompt engineering with LoRA for fine-tuning, significantly outperforming existing automated threat modeling tools.

Limitations

- The study is limited to banking systems and requires domain-specific datasets for other sectors.

- Resource constraints prevented the fine-tuning of larger open-source models like Llama-3.1-70B.

Future Work

- Extend the approach to other sectors like healthcare and IoT by customizing datasets and retraining models.

- Address generalization across domains and optimize resource efficiency for larger models.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThreMoLIA: Threat Modeling of Large Language Model-Integrated Applications

Davide Fucci, Oleksandr Adamov, Felix Viktor Jedrzejewski

Automating Prompt Leakage Attacks on Large Language Models Using Agentic Approach

Chi Wang, Davor Runje, Tvrtko Sternak et al.

Threat Modelling and Risk Analysis for Large Language Model (LLM)-Powered Applications

Stephen Burabari Tete

The Use of Large Language Models (LLM) for Cyber Threat Intelligence (CTI) in Cybercrime Forums

Vanessa Clairoux-Trepanier, Isa-May Beauchamp, Estelle Ruellan et al.

No citations found for this paper.

Comments (0)