Summary

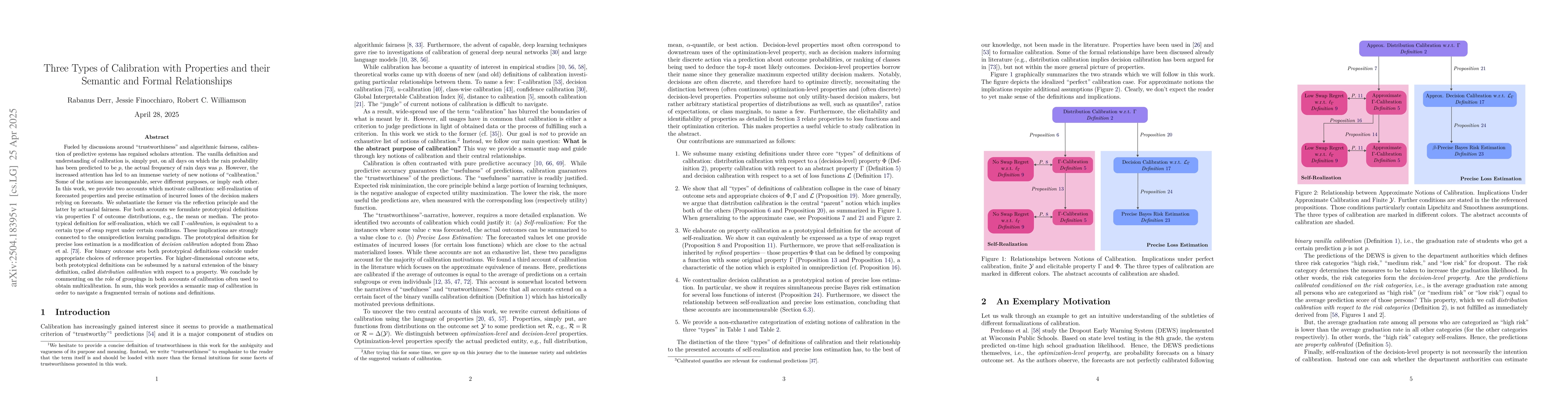

Fueled by discussions around "trustworthiness" and algorithmic fairness, calibration of predictive systems has regained scholars attention. The vanilla definition and understanding of calibration is, simply put, on all days on which the rain probability has been predicted to be p, the actual frequency of rain days was p. However, the increased attention has led to an immense variety of new notions of "calibration." Some of the notions are incomparable, serve different purposes, or imply each other. In this work, we provide two accounts which motivate calibration: self-realization of forecasted properties and precise estimation of incurred losses of the decision makers relying on forecasts. We substantiate the former via the reflection principle and the latter by actuarial fairness. For both accounts we formulate prototypical definitions via properties $\Gamma$ of outcome distributions, e.g., the mean or median. The prototypical definition for self-realization, which we call $\Gamma$-calibration, is equivalent to a certain type of swap regret under certain conditions. These implications are strongly connected to the omniprediction learning paradigm. The prototypical definition for precise loss estimation is a modification of decision calibration adopted from Zhao et al. [73]. For binary outcome sets both prototypical definitions coincide under appropriate choices of reference properties. For higher-dimensional outcome sets, both prototypical definitions can be subsumed by a natural extension of the binary definition, called distribution calibration with respect to a property. We conclude by commenting on the role of groupings in both accounts of calibration often used to obtain multicalibration. In sum, this work provides a semantic map of calibration in order to navigate a fragmented terrain of notions and definitions.

AI Key Findings

Generated Jun 09, 2025

Methodology

The paper employs a dual-account approach to calibration, motivated by self-realization of forecasted properties and precise estimation of decision-maker losses. It introduces prototypical definitions for calibration using properties Γ, examining swap regret and actuarial fairness.

Key Results

- Two prototypical definitions for calibration are formulated: Γ-calibration for self-realization and a modified decision calibration for precise loss estimation.

- For binary outcome sets, both prototypical definitions coincide under appropriate choices of reference properties.

- For higher-dimensional outcome sets, both definitions can be subsumed by a natural extension called distribution calibration with respect to a property.

- The paper establishes a semantic map of calibration to navigate the fragmented landscape of notions and definitions.

- Distribution calibration implies decision calibration, both in perfect and approximate cases, given mild assumptions on loss function boundedness.

Significance

This work contributes to the understanding of calibration by separating it into two accounts—self-realization and precise loss estimation—and providing formal relationships between various calibration notions.

Technical Contribution

The paper introduces a framework for understanding calibration through two distinct accounts: self-realization of forecasted properties and precise loss estimation, providing formal definitions and relationships between them.

Novelty

This research distinguishes itself by separating calibration into self-realization and precise loss estimation accounts, offering a comprehensive semantic map of calibration notions, and demonstrating connections between distribution calibration, decision calibration, and precise loss estimation.

Limitations

- The paper does not propose new algorithms or suggest a specific calibration notion as the optimal choice.

- Some findings rely on technical assumptions, which might not always hold in practical scenarios.

Future Work

- Investigate the implications of the findings for fair machine learning and subgroup calibration.

- Explore the relationship between calibration and other quality criteria for predictions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUsing Synchronic Definitions and Semantic Relations to Classify Semantic Change Types

Pierluigi Cassotti, Stefano De Pascale, Nina Tahmasebi

Primrose: Selecting Container Data Types by Their Properties

Michel Steuwer, Liam O'Connor, Xueying Qin

Discovering Affinity Relationships between Personality Types

Jean Marie Tshimula, Shengrui Wang, Belkacem Chikhaoui

No citations found for this paper.

Comments (0)