Summary

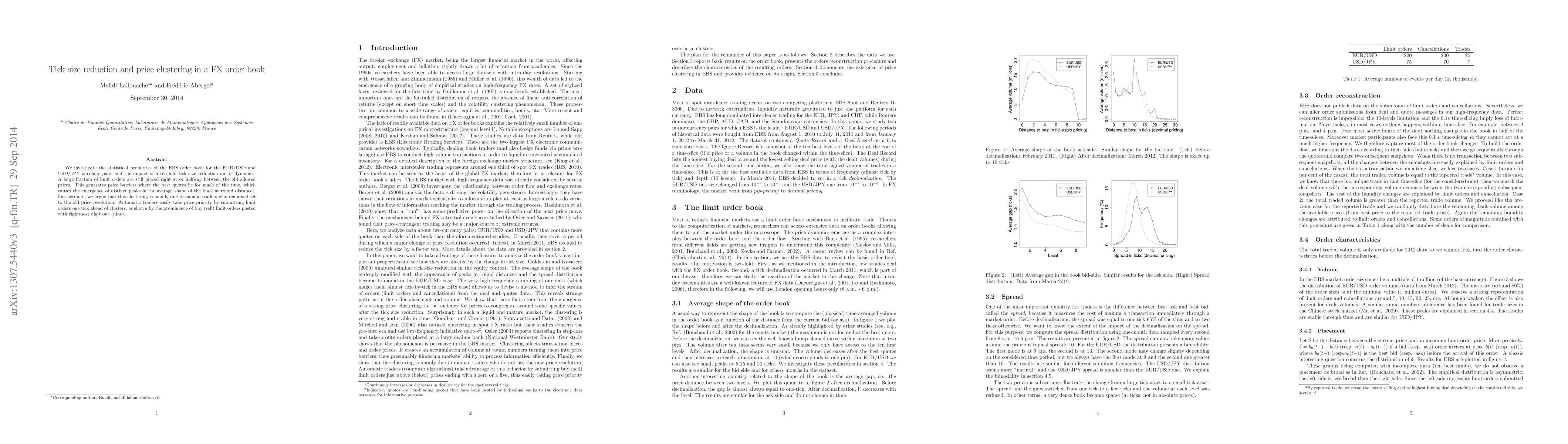

We investigate the statistical properties of the EBS order book for the EUR/USD and USD/JPY currency pairs and the impact of a ten-fold tick size reduction on its dynamics. A large fraction of limit orders are still placed right at or halfway between the old allowed prices. This generates price barriers where the best quotes lie for much of the time, which causes the emergence of distinct peaks in the average shape of the book at round distances. Furthermore, we argue that this clustering is mainly due to manual traders who remained set to the old price resolution. Automatic traders easily take price priority by submitting limit orders one tick ahead of clusters, as shown by the prominence of buy (sell) limit orders posted with rightmost digit one (nine).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo Tick-Size Too Small: A General Method for Modelling Small Tick Limit Order Books

Emmanuel Bacry, Konark Jain, Jonathan Kochems et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)