Authors

Summary

A classic problem in statistics is the estimation of the expectation of random variables from samples. This gives rise to the tightly connected problems of deriving concentration inequalities and confidence sequences, that is confidence intervals that hold uniformly over time. Previous work has shown how to easily convert the regret guarantee of an online betting algorithm into a time-uniform concentration inequality. In this paper, we show that we can go even further: We show that the regret of universal portfolio algorithms give rise to new implicit time-uniform concentrations and state-of-the-art empirically calculated confidence sequences. In particular, our numerically obtained confidence sequences can never be vacuous, even with a single sample, and satisfy the law of iterated logarithm.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

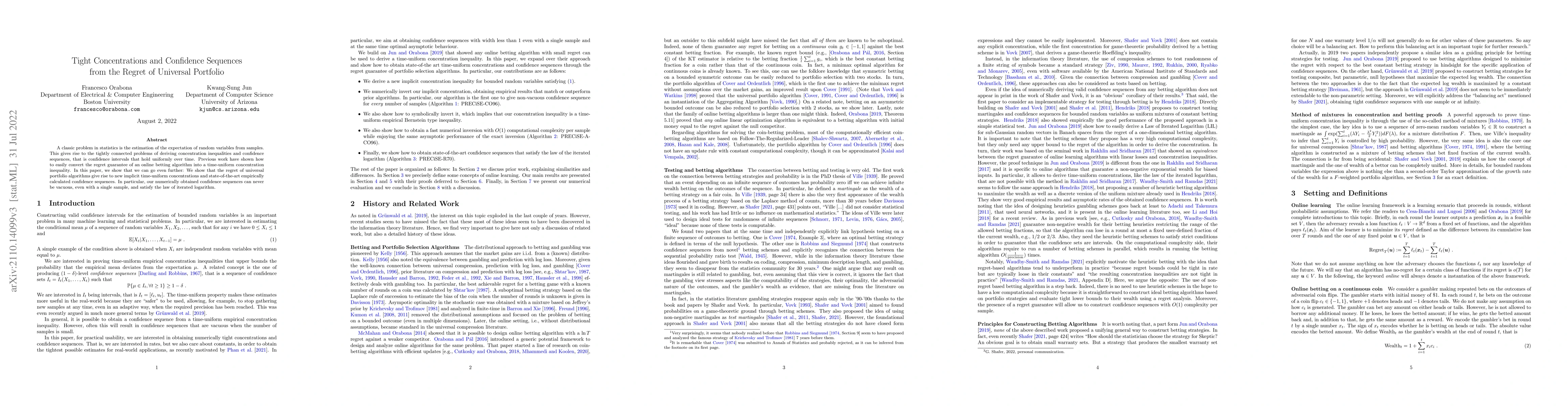

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConfidence Sequences for Generalized Linear Models via Regret Analysis

Wojciech Kotłowski, Eugenio Clerico, Gergely Neu et al.

On Confidence Sequences for Bounded Random Processes via Universal Gambling Strategies

J. Jon Ryu, Alankrita Bhatt

| Title | Authors | Year | Actions |

|---|

Comments (0)