Summary

In this paper we analyse time change equations (TCEs) for L\'evy-type processes in detail. To this end we establish a connection between TCEs and classical one-dimensional initial value problems (IVPs) which are easier to handle. Properties of the IVPs are linked with properties of the TCEs. We show in a general setting existence and uniqueness of solutions of the TCEs. Our main result is based on the general path properties for L\'evy-type processes found in Schnurr (2013). Applications include an existence result for processes which correspond to a certain class of given symbols.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

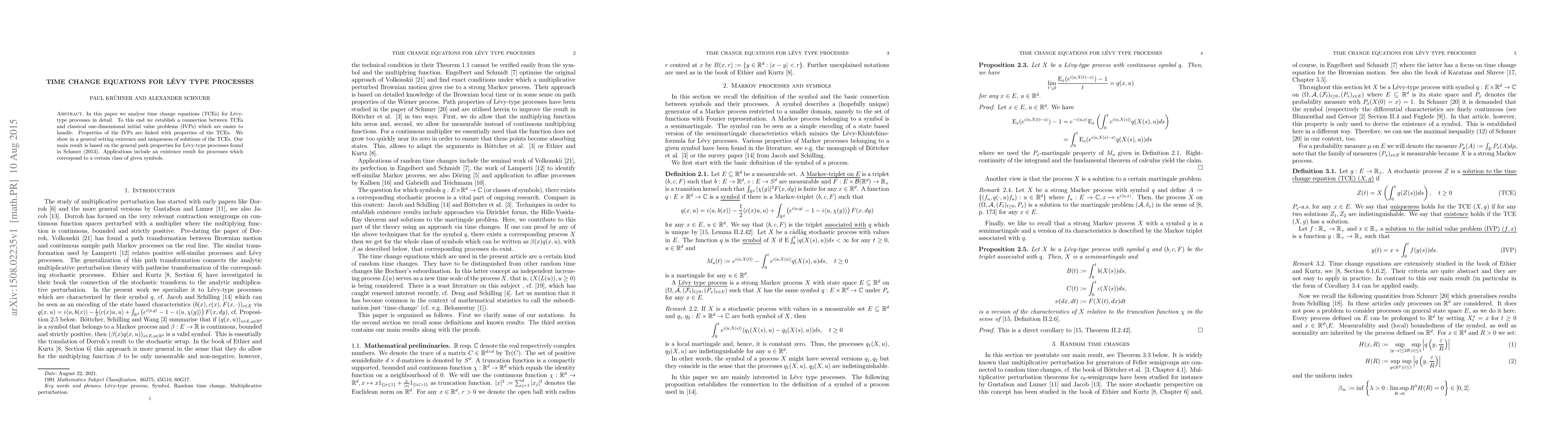

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)