Summary

We consider evaluation methods for payoffs with an inherent financial risk as encountered for instance for portfolios held by pension funds and insurance companies. Pricing such payoffs in a way consistent to market prices typically involves combining actuarial techniques with methods from mathematical finance. We propose to extend standard actuarial principles by a new market-consistent evaluation procedure which we call `two step market evaluation.' This procedure preserves the structure of standard evaluation techniques and has many other appealing properties. We give a complete axiomatic characterization for two step market evaluations. We show further that in a dynamic setting with a continuous stock prices process every evaluation which is time-consistent and market-consistent is a two step market evaluation. We also give characterization results and examples in terms of g-expectations in a Brownian-Poisson setting.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper introduces a new market-consistent evaluation procedure called 'two-step market evaluation' for financial payoffs, combining actuarial techniques with mathematical finance methods.

Key Results

- The paper proposes a complete axiomatic characterization for two-step market evaluations.

- In a dynamic setting with a continuous stock prices process, every time-consistent and market-consistent evaluation is shown to be a two-step market evaluation up to the next predictable time.

- Characterization results and examples in terms of g-expectations in a Brownian-Poisson setting are provided.

Significance

This research offers a computationally tractable tool for market-consistent valuations, preserving the structure of standard evaluation techniques and providing time-consistent evaluations.

Technical Contribution

The paper presents a novel two-step market evaluation procedure and provides a complete axiomatic characterization, linking it to g-expectations in a Brownian-Poisson setting.

Novelty

The two-step market evaluation procedure stands out by preserving the structure of standard evaluation techniques while ensuring time-consistency and market-consistency, offering a fresh perspective on combining actuarial and mathematical finance approaches.

Limitations

- The analysis is restricted to payoffs rather than payment streams.

- The paper does not explore the implications of the two-step market evaluation in more complex market models.

Future Work

- Investigate the application of two-step market evaluation in more complex financial markets and under various market conditions.

- Explore the extension of the method to handle more general types of payment streams.

Paper Details

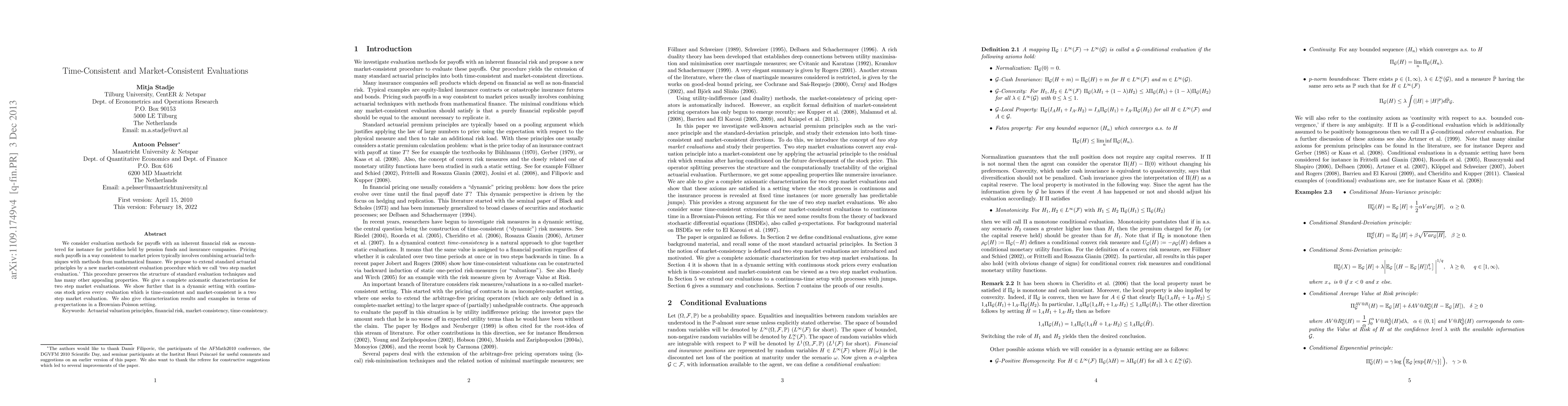

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)