Authors

Summary

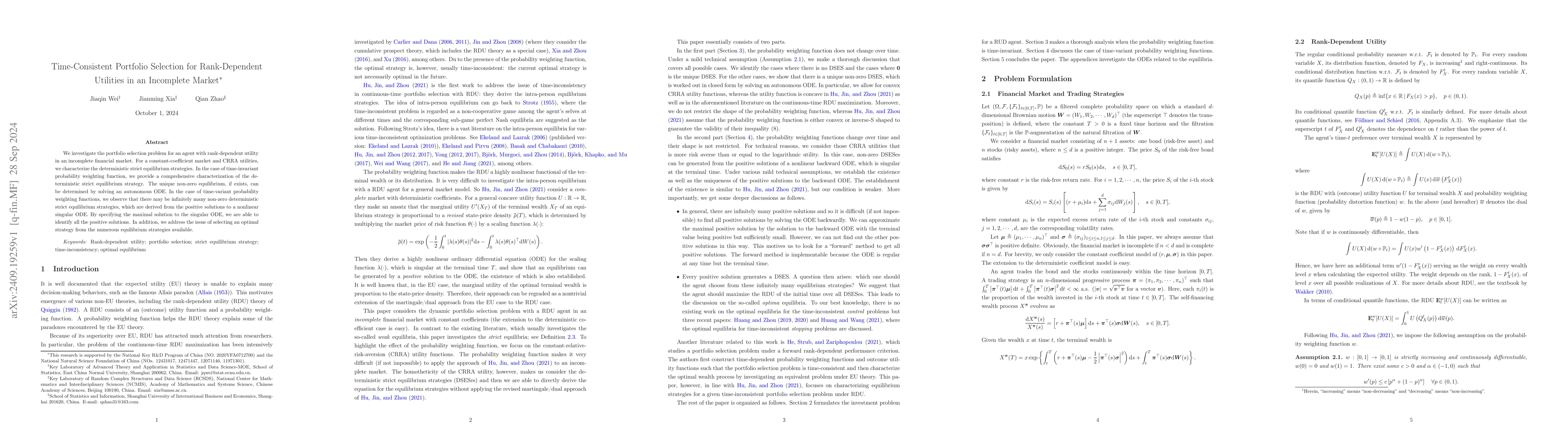

We investigate the portfolio selection problem for an agent with rank-dependent utility in an incomplete financial market. For a constant-coefficient market and CRRA utilities, we characterize the deterministic strict equilibrium strategies. In the case of time-invariant probability weighting function, we provide a comprehensive characterization of the deterministic strict equilibrium strategy. The unique non-zero equilibrium, if exists, can be determined by solving an autonomous ODE. In the case of time-variant probability weighting functions, we observe that there may be infinitely many non-zero deterministic strict equilibrium strategies, which are derived from the positive solutions to a nonlinear singular ODE. By specifying the maximal solution to the singular ODE, we are able to identify all the positive solutions. In addition, we address the issue of selecting an optimal strategy from the numerous equilibrium strategies available.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEquilibrium portfolio selection under beliefs-dependent utilities

Xiaochen Chen, Zongxia Liang, Guohui Guan

An Integral Equation Arising from Time-Consistent Portfolio Selection

Sheng Wang, Jianming Xia, Zongxia Liang

No citations found for this paper.

Comments (0)