Authors

Summary

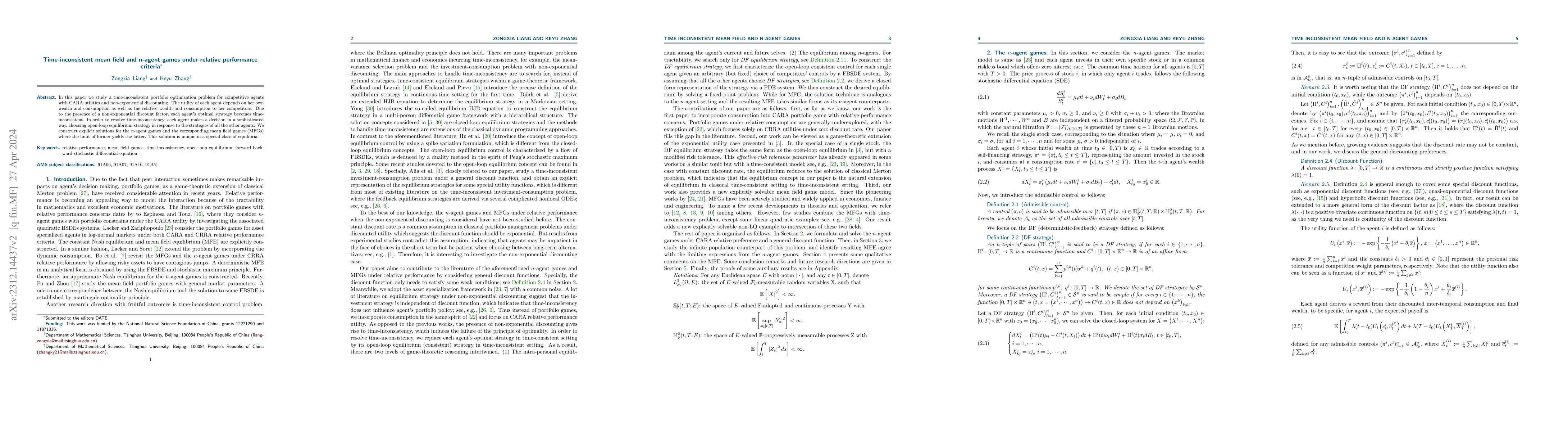

In this paper we study a time-inconsistent portfolio optimization problem for competitive agents with CARA utilities and non-exponential discounting. The utility of each agent depends on her own wealth and consumption as well as the relative wealth and consumption to her competitors. Due to the presence of a non-exponential discount factor, each agent's optimal strategy becomes time-inconsistent. In order to resolve time-inconsistency, each agent makes a decision in a sophisticated way, choosing open-loop equilibrium strategy in response to the strategies of all the other agents. We construct explicit solutions for the $n$-agent games and the corresponding mean field games (MFGs) where the limit of former yields the latter. This solution is unique in a special class of equilibria.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredictable Relative Forward Performance Processes: Multi-Agent and Mean Field Games for Portfolio Management

Yuwei Wang, Gechun Liang, Moris S. Strub

| Title | Authors | Year | Actions |

|---|

Comments (0)