Summary

In this paper, we formulate a general time-inconsistent stochastic linear--quadratic (LQ) control problem. The time-inconsistency arises from the presence of a quadratic term of the expected state as well as a state-dependent term in the objective functional. We define an equilibrium, instead of optimal, solution within the class of open-loop controls, and derive a sufficient condition for equilibrium controls via a flow of forward--backward stochastic differential equations. When the state is one dimensional and the coefficients in the problem are all deterministic, we find an explicit equilibrium control. As an application, we then consider a mean-variance portfolio selection model in a complete financial market where the risk-free rate is a deterministic function of time but all the other market parameters are possibly stochastic processes. Applying the general sufficient condition, we obtain explicit equilibrium strategies when the risk premium is both deterministic and stochastic.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

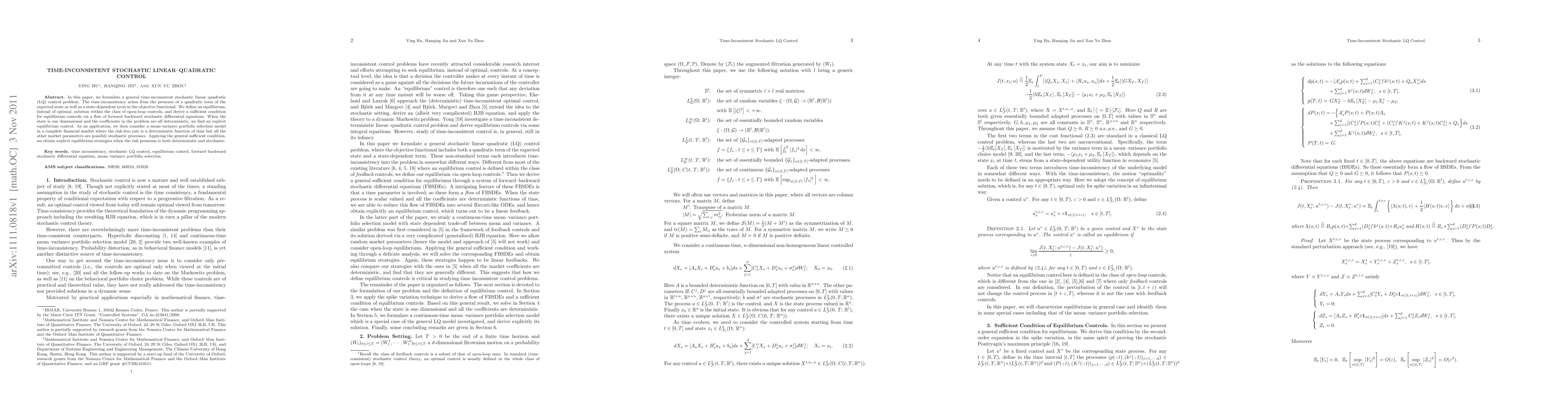

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)