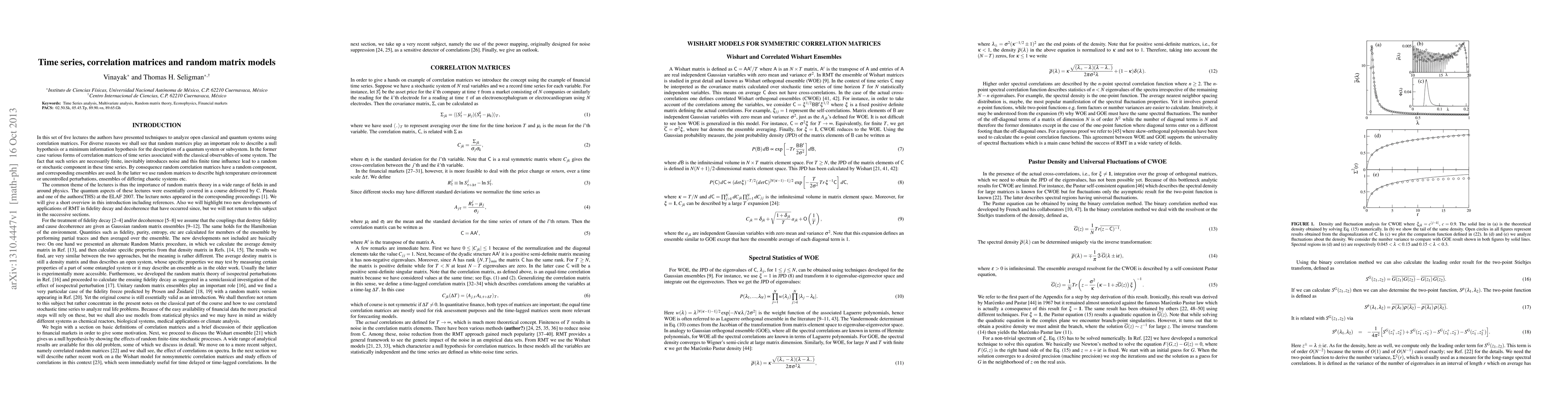

Summary

In this set of five lectures the authors have presented techniques to analyze open classical and quantum systems using correlation matrices. For diverse reasons we shall see that random matrices play an important role to describe a null hypothesis or a minimum information hypothesis for the description of a quantum system or subsystem. In the former case various forms of correlation matrices of time series associated with the classical observables of some system. The fact that such series are necessarily finite, inevitably introduces noise and this finite time influence lead to a random or stochastic component in these time series. By consequence random correlation matrices have a random component, and corresponding ensembles are used. In the latter we use random matrices to describe high temperature environment or uncontrolled perturbations, ensembles of differing chaotic systems etc.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)