Summary

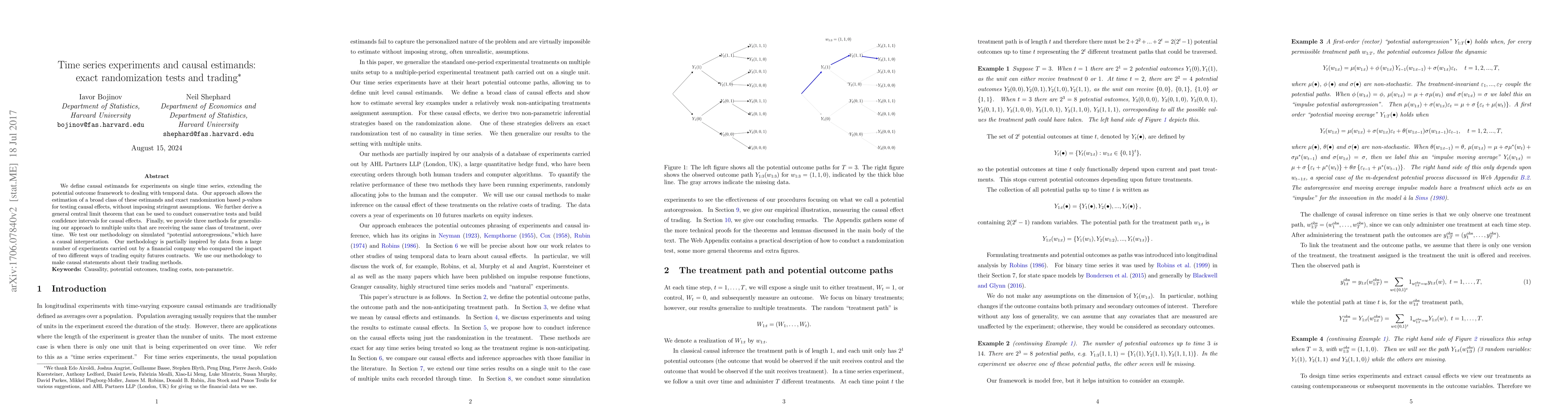

We define causal estimands for experiments on single time series, extending the potential outcome framework to dealing with temporal data. Our approach allows the estimation of some of these estimands and exact randomization based p-values for testing causal effects, without imposing stringent assumptions. We test our methodology on simulated "potential autoregressions,"which have a causal interpretation. Our methodology is partially inspired by data from a large number of experiments carried out by a financial company who compared the impact of two different ways of trading equity futures contracts. We use our methodology to make causal statements about their trading methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConditional Randomization Tests for Behavioral and Neural Time Series

Kenneth D. Harris, Kevin J. Miller

Mendelian Randomization Methods for Causal Inference: Estimands, Identification and Inference

Zhonghua Liu, Anqi Wang, Xihao Li et al.

Causal estimands and identification of time-varying effects in non-stationary time series from N-of-1 mobile device data

Jukka-Pekka Onnela, Li Zeng, Linda Valeri et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)