Summary

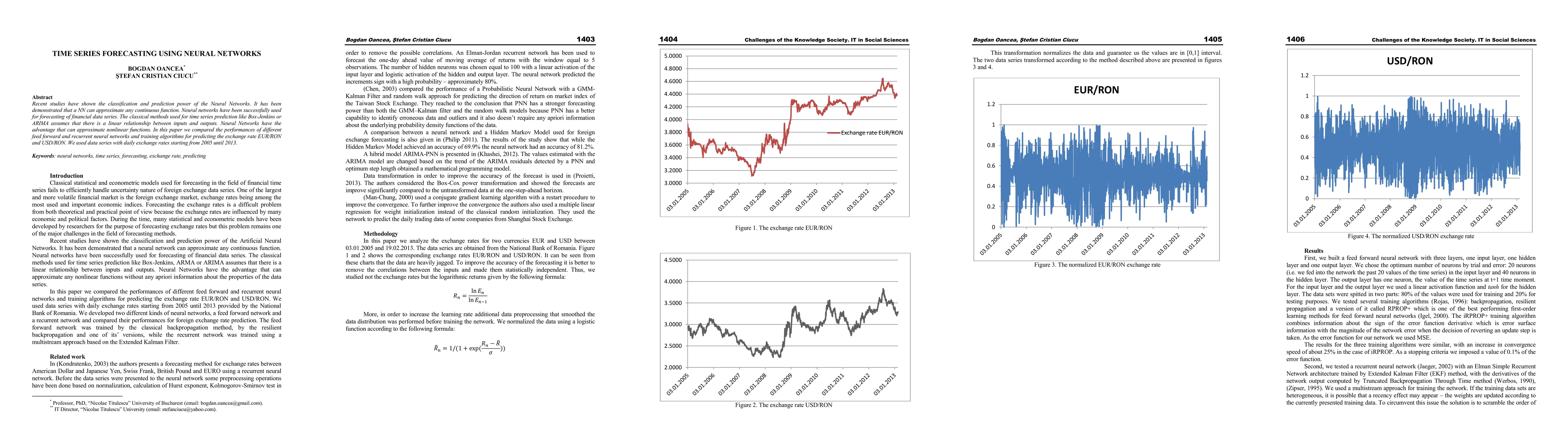

Recent studies have shown the classification and prediction power of the Neural Networks. It has been demonstrated that a NN can approximate any continuous function. Neural networks have been successfully used for forecasting of financial data series. The classical methods used for time series prediction like Box-Jenkins or ARIMA assumes that there is a linear relationship between inputs and outputs. Neural Networks have the advantage that can approximate nonlinear functions. In this paper we compared the performances of different feed forward and recurrent neural networks and training algorithms for predicting the exchange rate EUR/RON and USD/RON. We used data series with daily exchange rates starting from 2005 until 2013.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)