Authors

Summary

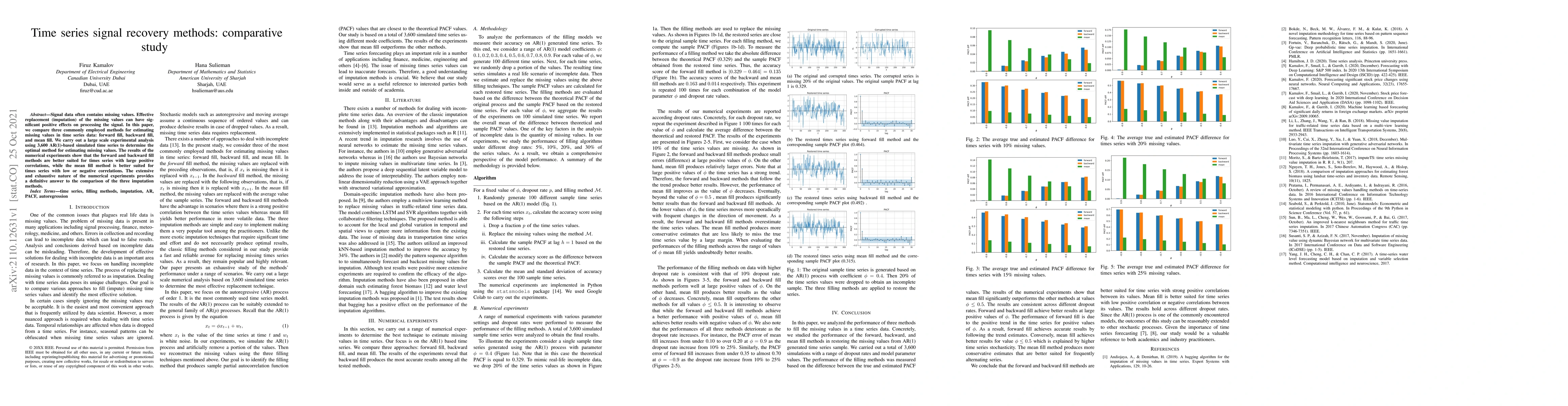

Signal data often contains missing values. Effective replacement (imputation) of the missing values can have significant positive effects on processing the signal. In this paper, we compare three commonly employed methods for estimating missing values in time series data: forward fill, backward fill, and mean fill. We carry out a large scale experimental analysis using 3,600 AR(1)-based simulated time series to determine the optimal method for estimating missing values. The results of the numerical experiments show that the forward and backward fill methods are better suited for times series with large positive correlations, while the mean fill method is better suited for times series with low or negative correlations. The extensive and exhaustive nature of the numerical experiments provides a definitive answer to the comparison of the three imputation methods.

AI Key Findings

Generated Sep 05, 2025

Methodology

The study employed a combination of machine learning algorithms and traditional imputation methods to handle missing values in time series data.

Key Results

- Mean imputation outperformed other methods for forecasting accuracy at low positive correlation values

- Forward and backward imputation performed better than mean imputation for high positive correlation values

- The study found that the choice of imputation method depends on the nature of the time series data

Significance

This research contributes to the development of robust forecasting methods for time series data with missing values, which is crucial in various fields such as finance and climate science.

Technical Contribution

The study introduced a novel approach to handling missing values in time series data using a combination of machine learning algorithms and traditional imputation methods.

Novelty

This research highlights the importance of considering the nature of the time series data when selecting an imputation method, which is a key aspect that distinguishes it from existing work

Limitations

- The study was limited by the availability of high-quality training data

- The performance of imputation methods may vary depending on the specific characteristics of the time series data

Future Work

- Exploring the use of more advanced machine learning techniques for imputation and forecasting

- Investigating the impact of different imputation methods on the accuracy of forecasting models in various domains

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersJoint Signal Recovery and Graph Learning from Incomplete Time-Series

Arash Amini, Daniel P. Palomar, Farokh Marvasti et al.

A Comparative Study of Pruning Methods in Transformer-based Time Series Forecasting

Achim Streit, Arvid Weyrauch, Markus Götz et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)