Summary

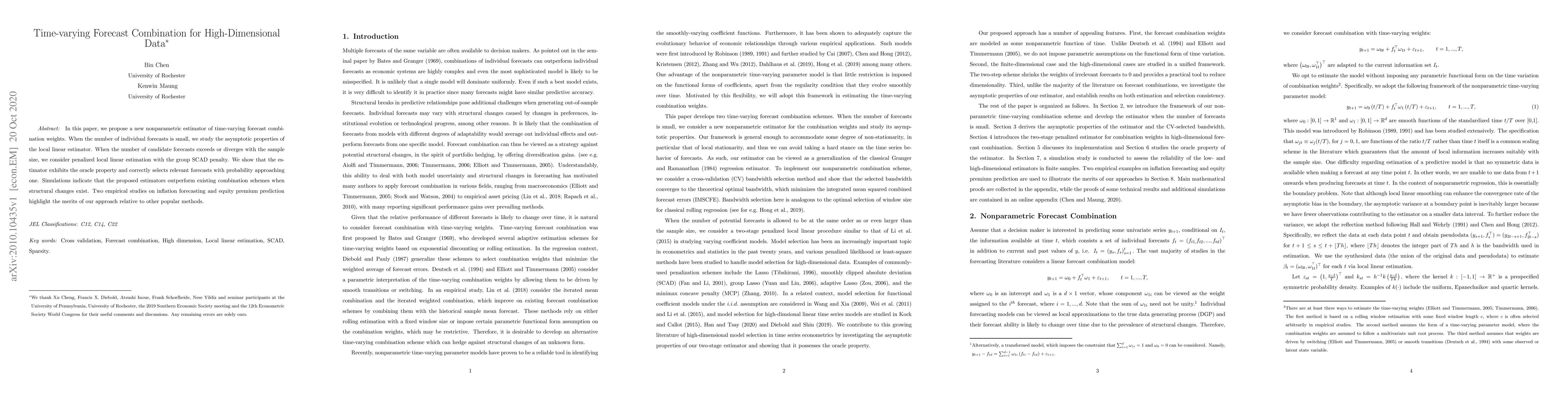

In this paper, we propose a new nonparametric estimator of time-varying forecast combination weights. When the number of individual forecasts is small, we study the asymptotic properties of the local linear estimator. When the number of candidate forecasts exceeds or diverges with the sample size, we consider penalized local linear estimation with the group SCAD penalty. We show that the estimator exhibits the oracle property and correctly selects relevant forecasts with probability approaching one. Simulations indicate that the proposed estimators outperform existing combination schemes when structural changes exist. Two empirical studies on inflation forecasting and equity premium prediction highlight the merits of our approach relative to other popular methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian forecast combination using time-varying features

Li Li, Feng Li, Yanfei Kang

High-Dimensional Time-Varying Coefficient Estimation

Donggyu Kim, Minseok Shin, Minseog Oh

Coherent forecast combination for linearly constrained multiple time series

Daniele Girolimetto, Tommaso Di Fonzo

High-dimensional point forecast combinations for emergency department demand

Jue Tao Lim, Pei Ma, Peihong Guo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)