Authors

Summary

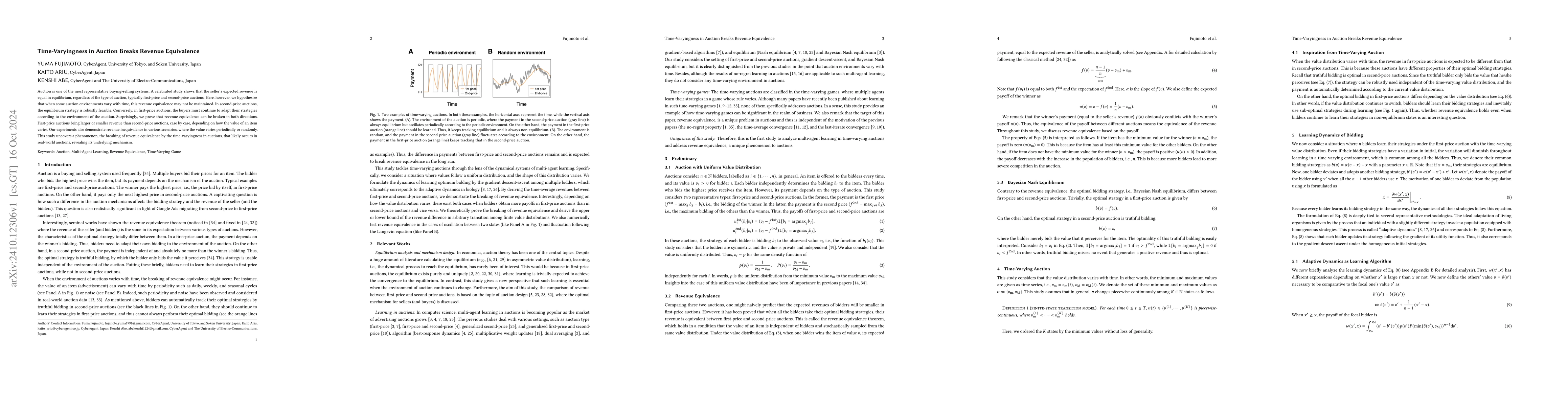

Auction is one of the most representative buying-selling systems. A celebrated study shows that the seller's expected revenue is equal in equilibrium, regardless of the type of auction, typically first-price and second-price auctions. Here, however, we hypothesize that when some auction environments vary with time, this revenue equivalence may not be maintained. In second-price auctions, the equilibrium strategy is robustly feasible. Conversely, in first-price auctions, the buyers must continue to adapt their strategies according to the environment of the auction. Surprisingly, we prove that revenue equivalence can be broken in both directions. First-price auctions bring larger or smaller revenue than second-price auctions, case by case, depending on how the value of an item varies. Our experiments also demonstrate revenue inequivalence in various scenarios, where the value varies periodically or randomly. This study uncovers a phenomenon, the breaking of revenue equivalence by the time-varyingness in auctions, that likely occurs in real-world auctions, revealing its underlying mechanism.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)