Summary

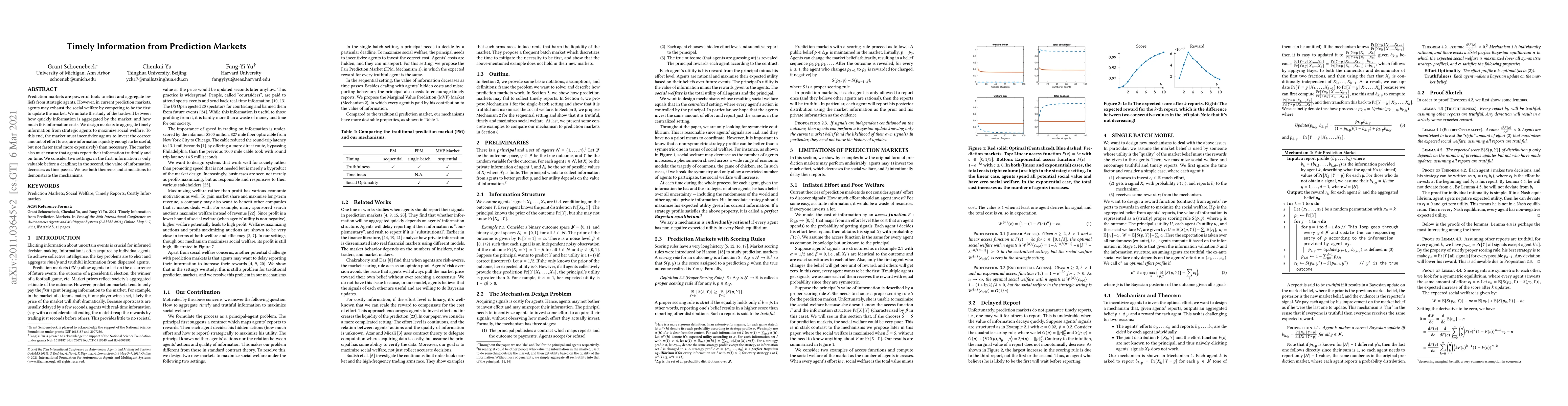

Prediction markets are powerful tools to elicit and aggregate beliefs from strategic agents. However, in current prediction markets, agents may exhaust the social welfare by competing to be the first to update the market. We initiate the study of the trade-off between how quickly information is aggregated by the market, and how much this information costs. We design markets to aggregate timely information from strategic agents to maximize social welfare. To this end, the market must incentivize agents to invest the correct amount of effort to acquire information: quickly enough to be useful, but not faster (and more expensively) than necessary. The market also must ensure that agents report their information truthfully and on time. We consider two settings: in the first, information is only valuable before a deadline; in the second, the value of information decreases as time passes. We use both theorems and simulations to demonstrate the mechanisms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFalse Consensus, Information Theory, and Prediction Markets

Yuqing Kong, Grant Schoenebeck

| Title | Authors | Year | Actions |

|---|

Comments (0)