Summary

We investigate a class of optimal stopping problems arising in, for example, studies considering the timing of an irreversible investment when the underlying follows a skew Brownian motion. Our results indicate that the local directional predictability modeled by the presence of a skew point for the underlying has a nontrivial and somewhat surprising impact on the timing incentives of the decision maker. We prove that waiting is always optimal at the skew point for a large class of exercise payoffs. An interesting consequence of this finding, which is in sharp contrast with studies relying on ordinary Brownian motion, is that the exercise region for the problem can become unconnected even when the payoff is linear. We also establish that higher skewness increases the incentives to wait and postpones the optimal timing of an investment opportunity. Our general results are explicitly illustrated for a piecewise linear payoff.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

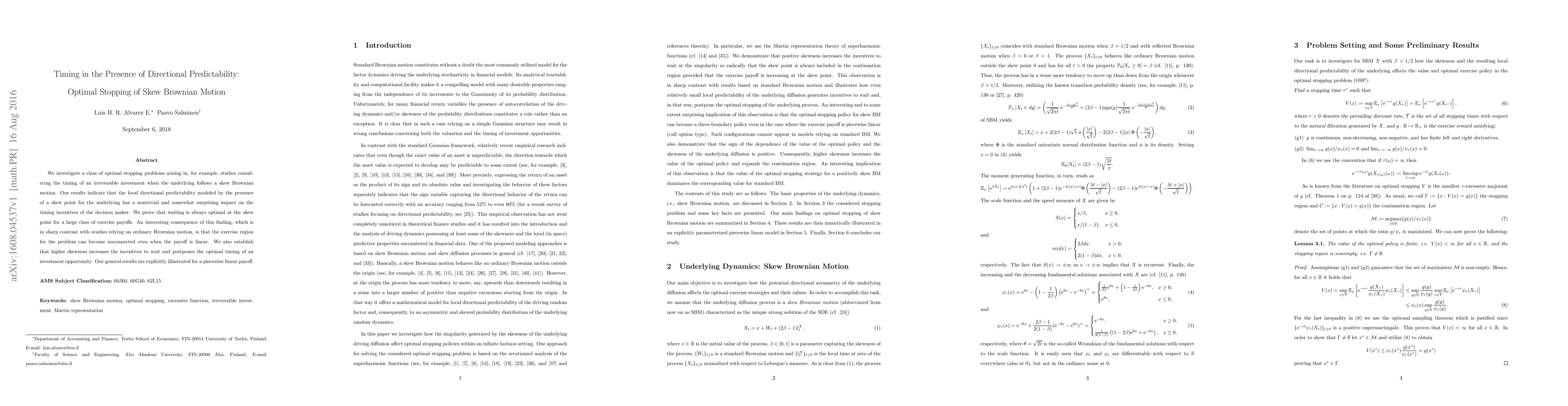

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)