Summary

This paper analyzes the timing options embedded in a startup firm, and the associated market entry and exit timing decisions under the exogenous risks of early termination and competitor's entry. Our valuation approach leads to the analytical study of a non-standard perpetual American installment option nested with an optimal sequential stopping problem. Explicit formulas are derived for the firm's value functions. Analytically and numerically, we show that early termination risk leads to earlier voluntary entry or exit, and the threat of competition has a non-trivial effect on the firm's entry and abandonment strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

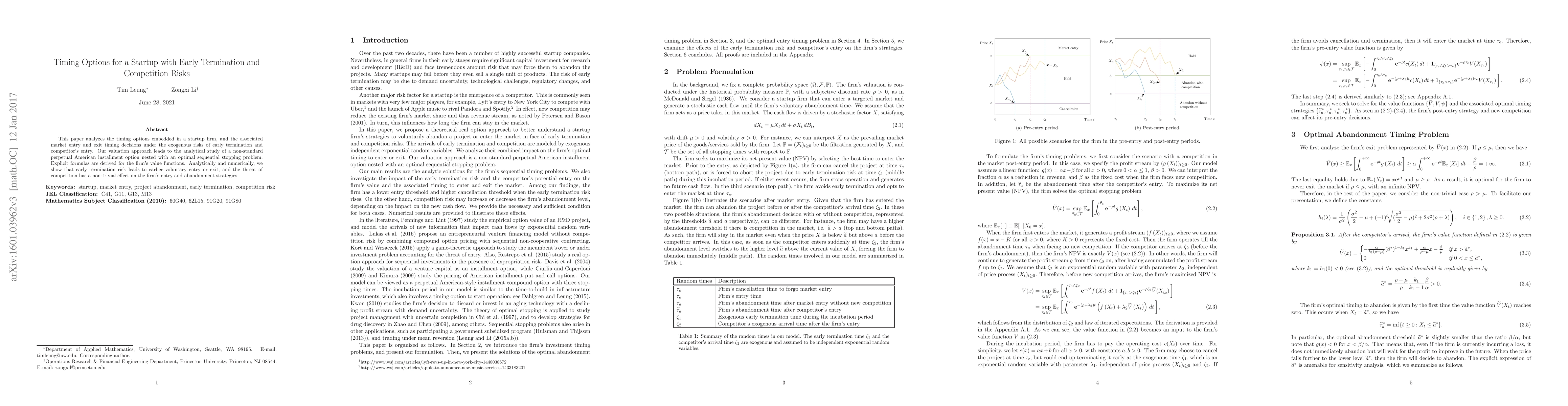

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)