Authors

Summary

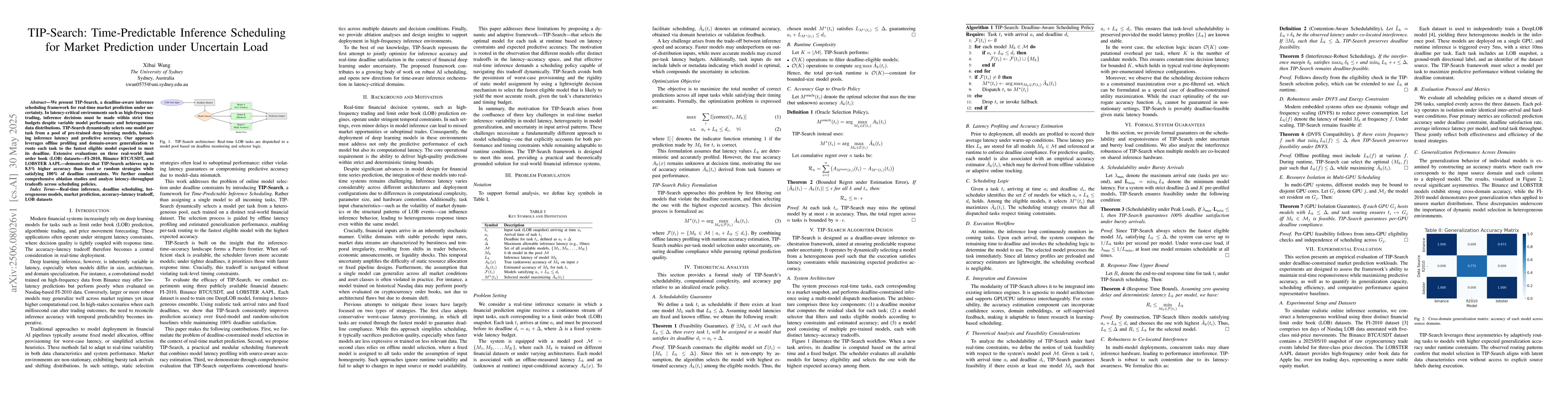

This paper proposes TIP-Search, a time-predictable inference scheduling framework for real-time market prediction under uncertain workloads. Motivated by the strict latency demands in high-frequency financial systems, TIP-Search dynamically selects a deep learning model from a heterogeneous pool, aiming to maximize predictive accuracy while satisfying per-task deadline constraints. Our approach profiles latency and generalization performance offline, then performs online task-aware selection without relying on explicit input domain labels. We evaluate TIP-Search on three real-world limit order book datasets (FI-2010, Binance BTC/USDT, LOBSTER AAPL) and demonstrate that it outperforms static baselines with up to 8.5% improvement in accuracy and 100% deadline satisfaction. Our results highlight the effectiveness of TIP-Search in robust low-latency financial inference under uncertainty.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust DNN Partitioning and Resource Allocation Under Uncertain Inference Time

Sheng Zhou, Zhaojun Nan, Zhisheng Niu et al.

Data-Driven Modeling of Aggregate Flexibility under Uncertain and Non-Convex Load Models

Vassilis Kekatos, Baosen Zhang, Sina Taheri et al.

No citations found for this paper.

Comments (0)