Summary

Financial markets worldwide do not have the same working hours. As a consequence, the study of correlation or causality between financial market indices becomes dependent on wether we should consider in computations of correlation matrices all indices in the same day or lagged indices. The answer this article proposes is that we should consider both. In this work, we use 79 indices of a diversity of stock markets across the world in order to study their correlation structure, and discover that representing in the same network original and lagged indices, we obtain a better understanding of how indices that operate at different hours relate to each other.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

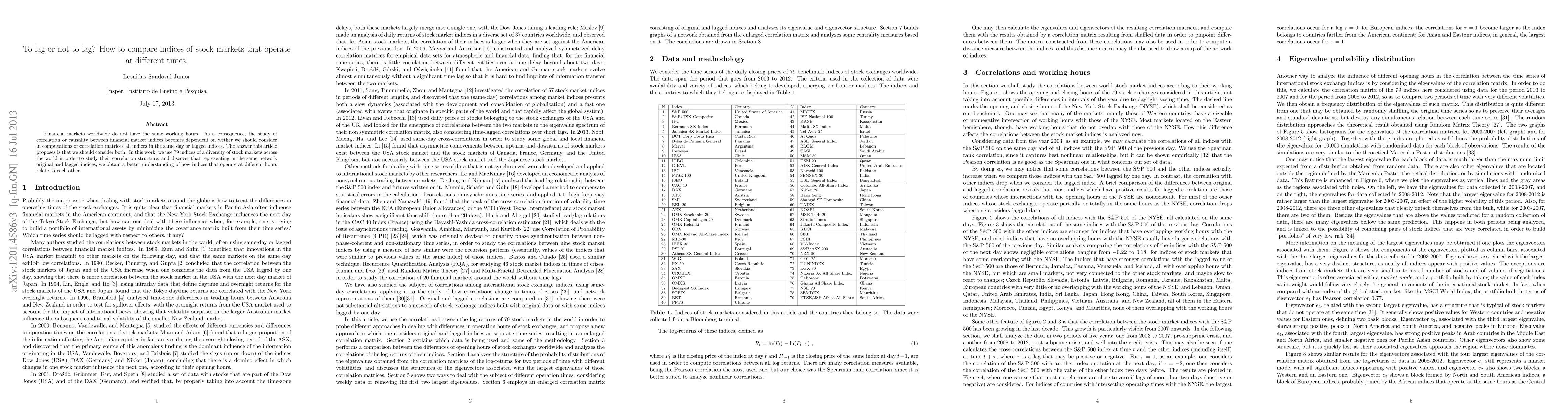

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)