Summary

Stock return forecasting is of utmost importance in the business world. This has been the favourite topic of research for many academicians since decades. Recently, regularization techniques have reported to tremendously increase the forecast accuracy of the simple regression model. Still, this model cannot incorporate the effect of things like a major natural disaster, large foreign influence, etc. in its prediction. Such things affect the whole stock market and are very unpredictable. Thus, it is more important to recommend top stocks rather than predicting exact stock returns. The present paper modifies the regression task to output value for each stock which is more suitable for ranking the stocks by expected returns. Two large datasets consisting of altogether 1205 companies listed at Indian exchanges were used for experimentation. Five different metrics were used for evaluating the different models. Results were also analysed subjectively through plots. The results showed the superiority of the proposed techniques.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

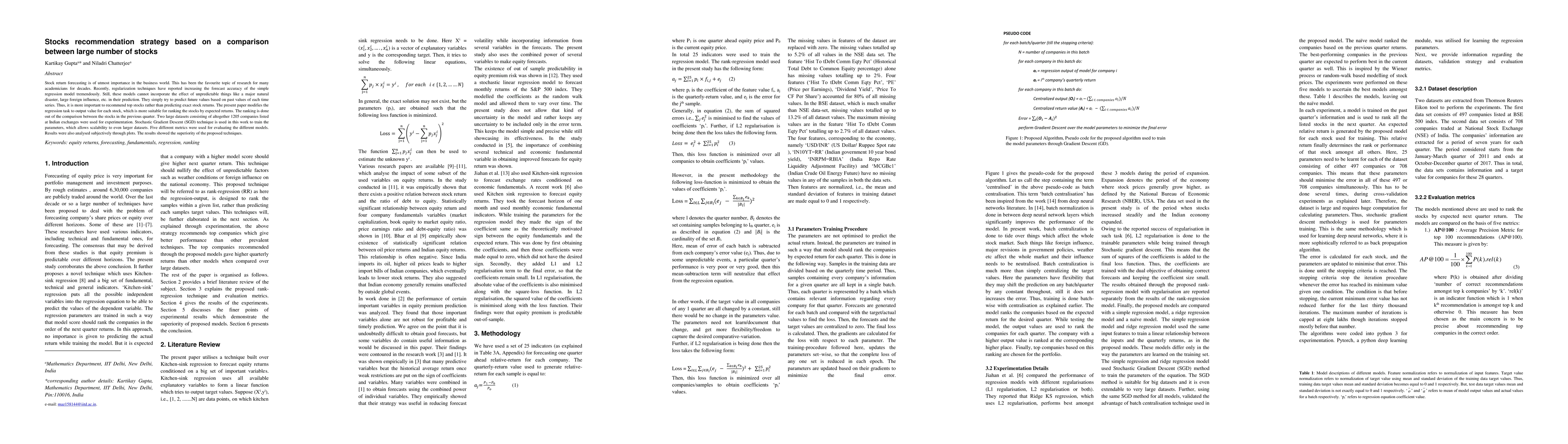

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPerformance Evaluation of Equal-Weight Portfolio and Optimum Risk Portfolio on Indian Stocks

Jaydip Sen, Abhiraj Sen

A novel portfolio construction strategy based on the core-periphery profile of stocks

Imran Ansari, Niteesh Sahni, Charu Sharma et al.

No citations found for this paper.

Comments (0)