Summary

This is an overview of the area of Stochastic Portfolio Theory, and can be seen as an updated and extended version of the survey paper by Fernholz and Karatzas (Handbook of Numerical Analysis Vol.15:89-167, 2009).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

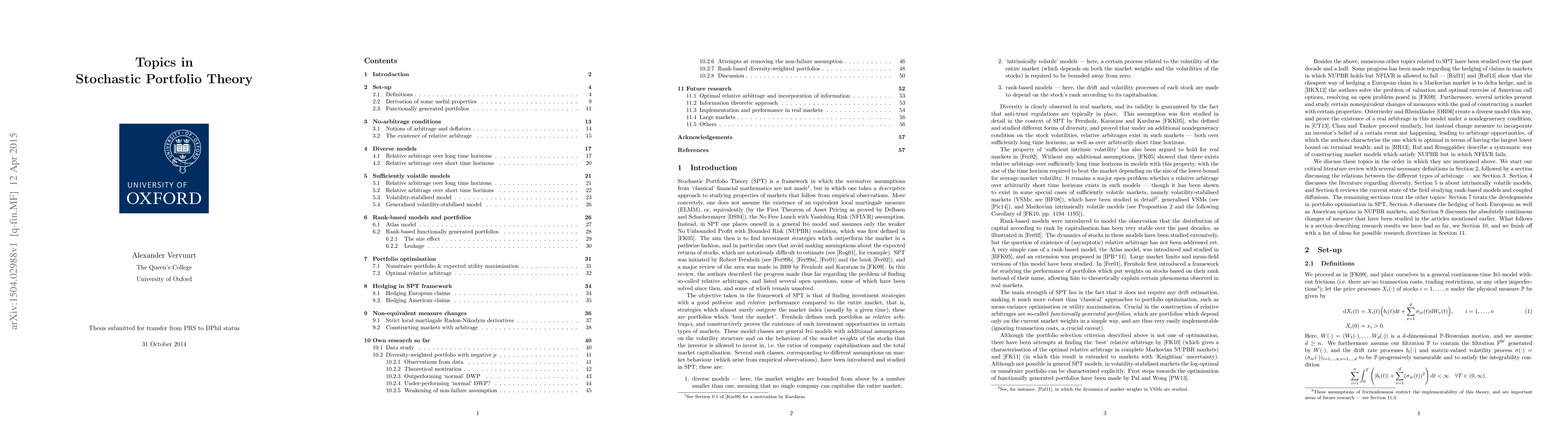

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)