Summary

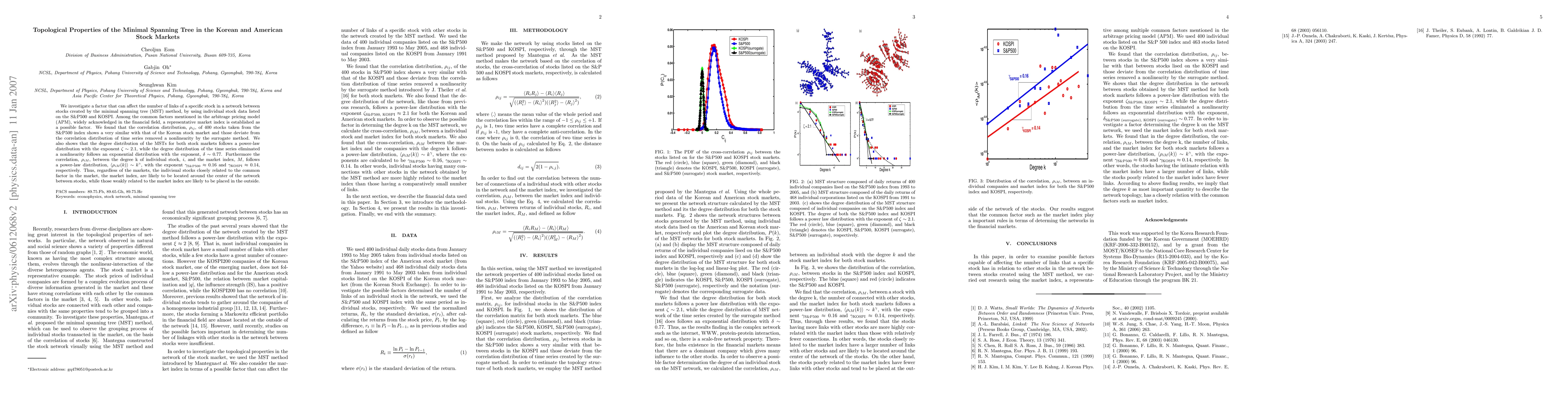

We investigate a factor that can affect the number of links of a specific stock in a network between stocks created by the minimal spanning tree (MST) method, by using individual stock data listed on the S&P500 and KOSPI. Among the common factors mentioned in the arbitrage pricing model (APM), widely acknowledged in the financial field, a representative market index is established as a possible factor. We found that the correlation distribution, $\rho_{ij}$, of 400 stocks taken from the S&P500 index shows a very similar with that of the Korean stock market and those deviate from the correlation distribution of time series removed a nonlinearity by the surrogate method. We also shows that the degree distribution of the MSTs for both stock markets follows a power-law distribution with the exponent $\zeta \sim$ 2.1, while the degree distribution of the time series eliminated a nonlinearity follows an exponential distribution with the exponent, $\delta \sim 0.77$. Furthermore the correlation, $\rho_{iM}$, between the degree k of individual stock, $i$, and the market index, $M$, follows a power-law distribution, $<\rho_{iM}(k) > \sim k^{\gamma}$, with the exponent $\gamma_{\textrm{S&P500}} \approx 0.16$ and $\gamma_{\textrm{KOSPI}} \approx 0.14$, respectively. Thus, regardless of the markets, the indivisual stocks closely related to the common factor in the market, the market index, are likely to be located around the center of the network between stocks, while those weakly related to the market index are likely to be placed in the outside.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)