Summary

Digital payments traditionally rely on online communications with several intermediaries such as banks, payment networks, and payment processors in order to authorize and process payment transactions. While these communication networks are designed to be highly available with continuous uptime, there may be times when an end-user experiences little or no access to network connectivity. The growing interest in digital forms of payments has led central banks around the world to explore the possibility of issuing a new type of central-bank money, known as central bank digital currency (CBDC). To facilitate the secure issuance and transfer of CBDC, we envision a CBDC design under a two-tier hierarchical trust infrastructure, which is implemented using public-key cryptography with the central bank as the root certificate authority for generating digital signatures, and other financial institutions as intermediate certificate authorities. One important design feature for CBDC that can be developed under this hierarchical trust infrastructure is an offline capability to create secure point-to-point offline payments through the use of authorized hardware. An offline capability for CBDC as digital cash can create a resilient payment system for consumers and businesses to transact in any situation. We propose an offline payment system (OPS) protocol for CBDC that allows a user to make digital payments to another user while both users are temporarily offline and unable to connect to payment intermediaries (or even the Internet). OPS can be used to instantly complete a transaction involving any form of digital currency over a point-to-point channel without communicating with any payment intermediary, achieving virtually unbounded throughput and real-time transaction latency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

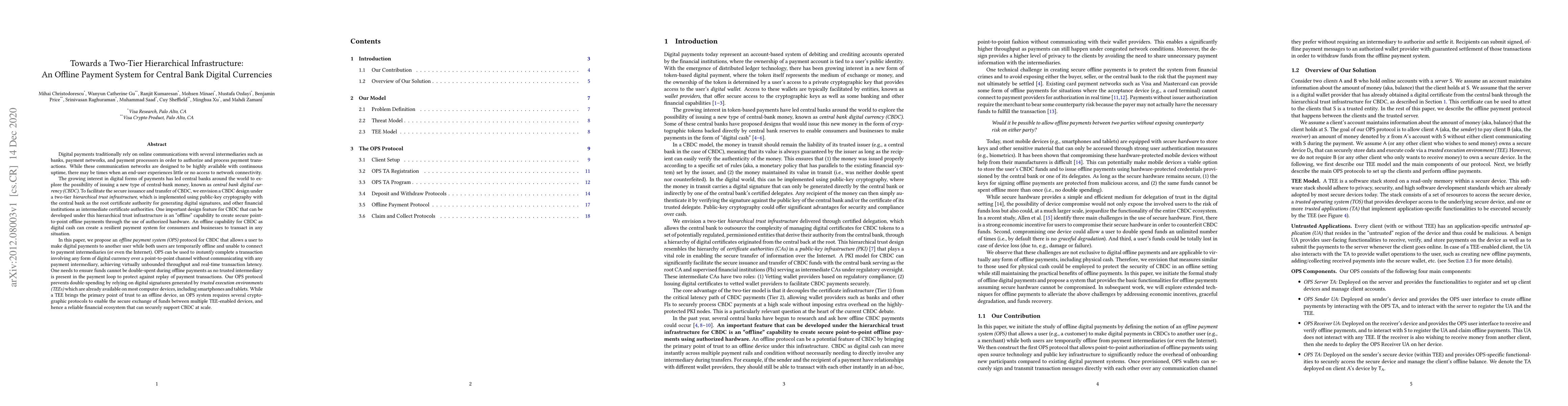

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThreshold Signatures for Central Bank Digital Currencies

Lars Hupel, Georg Carle, Filip Rezabek et al.

How to design a Public Key Infrastructure for a Central Bank Digital Currency

Lars Hupel, Makan Rafiee

| Title | Authors | Year | Actions |

|---|

Comments (0)