Authors

Summary

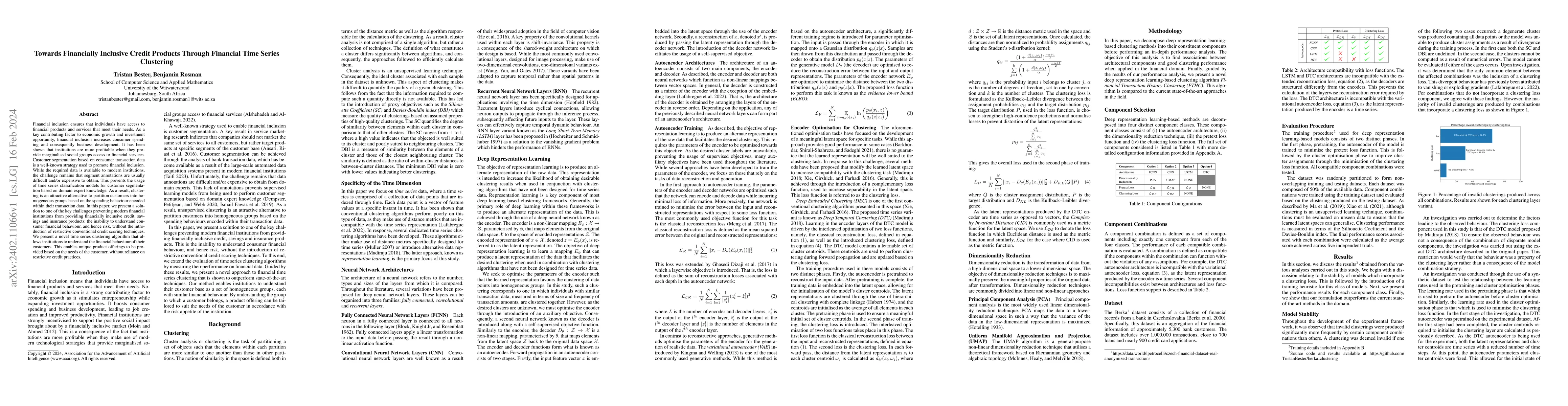

Financial inclusion ensures that individuals have access to financial products and services that meet their needs. As a key contributing factor to economic growth and investment opportunity, financial inclusion increases consumer spending and consequently business development. It has been shown that institutions are more profitable when they provide marginalised social groups access to financial services. Customer segmentation based on consumer transaction data is a well-known strategy used to promote financial inclusion. While the required data is available to modern institutions, the challenge remains that segment annotations are usually difficult and/or expensive to obtain. This prevents the usage of time series classification models for customer segmentation based on domain expert knowledge. As a result, clustering is an attractive alternative to partition customers into homogeneous groups based on the spending behaviour encoded within their transaction data. In this paper, we present a solution to one of the key challenges preventing modern financial institutions from providing financially inclusive credit, savings and insurance products: the inability to understand consumer financial behaviour, and hence risk, without the introduction of restrictive conventional credit scoring techniques. We present a novel time series clustering algorithm that allows institutions to understand the financial behaviour of their customers. This enables unique product offerings to be provided based on the needs of the customer, without reliance on restrictive credit practices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)