Summary

We propose STONK (Stock Optimization using News Knowledge), a multimodal framework integrating numerical market indicators with sentiment-enriched news embeddings to improve daily stock-movement prediction. By combining numerical & textual embeddings via feature concatenation and cross-modal attention, our unified pipeline addresses limitations of isolated analyses. Backtesting shows STONK outperforms numeric-only baselines. A comprehensive evaluation of fusion strategies and model configurations offers evidence-based guidance for scalable multimodal financial forecasting. Source code is available on GitHub

AI Key Findings

Generated Sep 07, 2025

Methodology

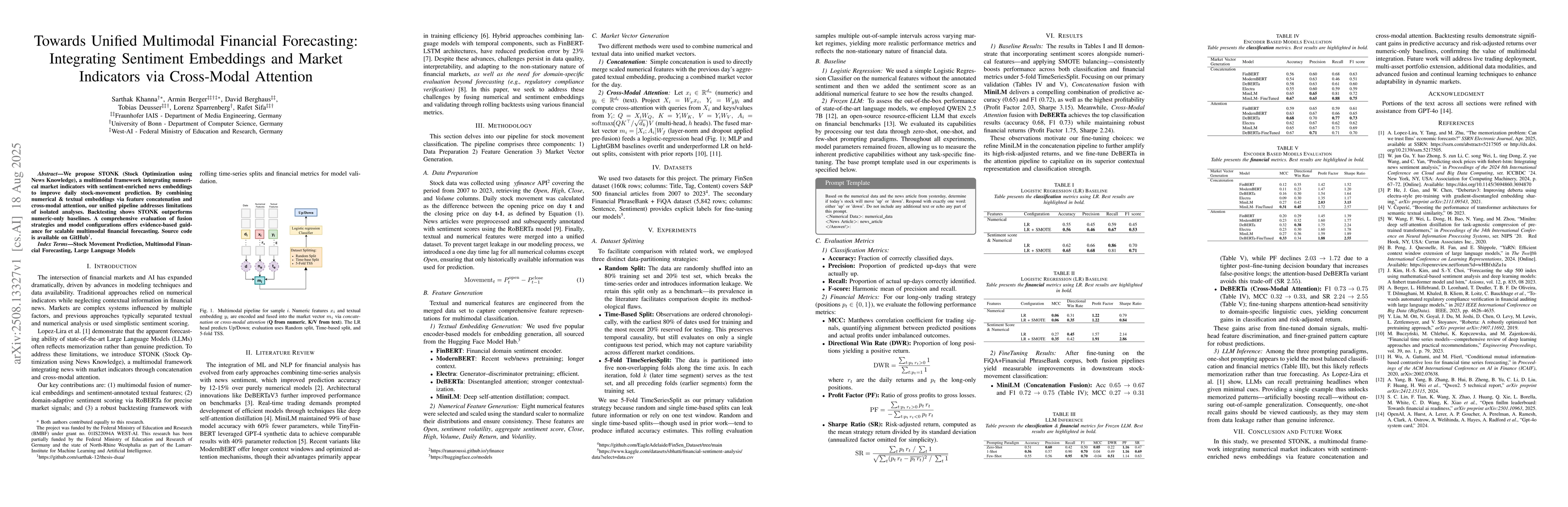

The methodology involves collecting stock data using yfinance API, preprocessing news articles, annotating them with sentiment scores using RoBERTa, and engineering textual and numerical features. Two methods are used for market vector generation: concatenation and cross-modal attention. The pipeline is validated through rolling backtests using various financial metrics.

Key Results

- STONK outperforms numeric-only baselines in backtesting.

- Concatenation fusion with MiniLM achieves high predictive accuracy (0.65) and F1 (0.72) with robust financial returns (ProfitFactor 2.03, Sharpe 3.15).

- Cross-Modal Attention fusion with DeBERTa achieves top classification results (accuracy 0.68, F1 0.73) with strong financial returns (ProfitFactor 1.75, Sharpe 2.24).

- Fine-tuning MiniLM in the concatenation pipeline amplifies its high-risk-adjusted returns, while fine-tuning DeBERTa in the attention pipeline capitalizes on its superior contextual representation and classification strength.

Significance

This research is significant as it presents STONK, a multimodal framework that integrates numerical market indicators with sentiment-enriched news embeddings, demonstrating substantial gains in predictive accuracy and risk-adjusted returns over numeric-only baselines, confirming the value of multimodal integration in financial forecasting.

Technical Contribution

The main technical contribution is the development of STONK, a unified multimodal framework that integrates sentiment embeddings and market indicators via cross-modal attention for improved daily stock-movement prediction.

Novelty

This work stands out by offering a comprehensive evaluation of fusion strategies and model configurations, providing evidence-based guidance for scalable multimodal financial forecasting, and addressing the limitations of isolated analyses of numerical and textual data in financial forecasting.

Limitations

- The study does not address live trading deployment.

- The research is currently limited to single-asset stock movement prediction and does not extend to multi-asset portfolio strategies.

Future Work

- Future work will focus on live trading deployment and extending the model to multi-asset portfolio strategies.

- Additional data modalities and advanced fusion and continual learning techniques will be explored to enhance adaptability in dynamic markets.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCross-Modal Temporal Fusion for Financial Market Forecasting

John Cartlidge, Yunhua Pei, Daniel Gold et al.

Multimodal Contrastive Learning via Uni-Modal Coding and Cross-Modal Prediction for Multimodal Sentiment Analysis

Haifeng Hu, Ronghao Lin

Open-set Cross Modal Generalization via Multimodal Unified Representation

Yan Xia, Zhou Zhao, Tao Jin et al.

Comments (0)