Authors

Summary

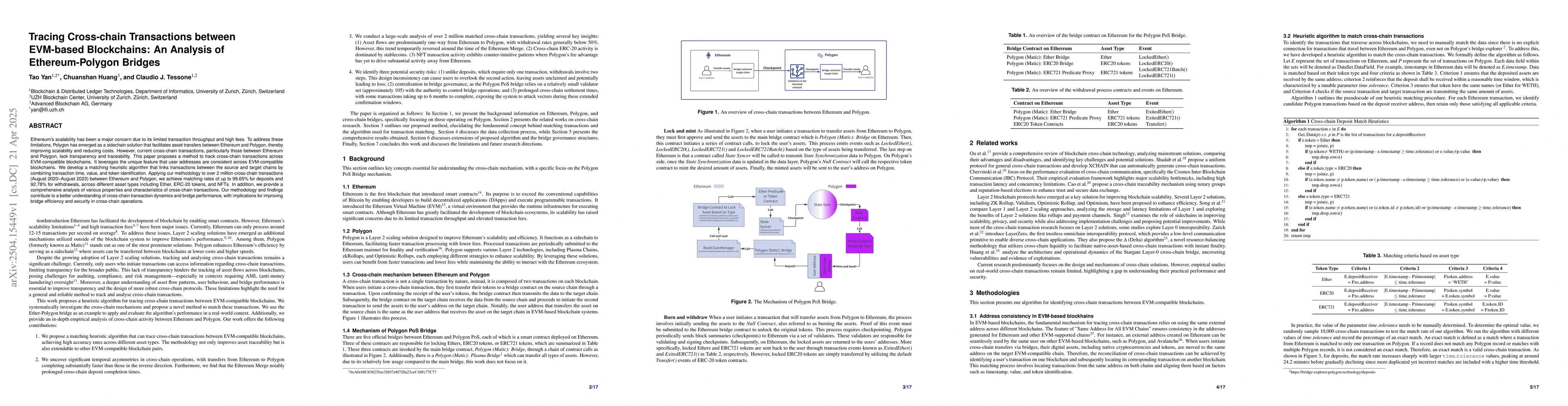

Ethereum's scalability has been a major concern due to its limited transaction throughput and high fees. To address these limitations, Polygon has emerged as a sidechain solution that facilitates asset transfers between Ethereum and Polygon, thereby improving scalability and reducing costs. However, current cross-chain transactions, particularly those between Ethereum and Polygon, lack transparency and traceability. This paper proposes a method to track cross-chain transactions across EVM-compatible blockchains. It leverages the unique feature that user addresses are consistent across EVM-compatible blockchains. We develop a matching heuristic algorithm that links transactions between the source and target chains by combining transaction time, value, and token identification. Applying our methodology to over 2 million cross-chain transactions (August 2020-August 2023) between Ethereum and Polygon, we achieve matching rates of up to 99.65% for deposits and 92.78% for withdrawals, across different asset types including Ether, ERC-20 tokens, and NFTs. In addition, we provide a comprehensive analysis of various properties and characteristics of cross-chain transactions. Our methodology and findings contribute to a better understanding of cross-chain transaction dynamics and bridge performance, with implications for improving bridge efficiency and security in cross-chain operations.

AI Key Findings

Generated Jun 09, 2025

Methodology

The paper develops a matching heuristic algorithm that links transactions between Ethereum and Polygon by combining transaction time, value, and token identification, leveraging consistent user addresses across EVM-compatible blockchains.

Key Results

- The algorithm achieved matching rates of up to 99.65% for deposits and 92.78% for withdrawals across different asset types including Ether, ERC-20 tokens, and NFTs.

- Deposit match rates exceeded 93% for all three asset types, while withdrawal match rates were consistently lower, with notable variation across token types.

- ERC721 tokens demonstrated the highest match rates (99.65% deposits, 92.78% withdrawals), while ERC20 tokens had the lowest withdrawal match rate (67.55%) despite a strong deposit match rate (93.04%).

Significance

This research contributes to a better understanding of cross-chain transaction dynamics and bridge performance, with implications for improving bridge efficiency and security in cross-chain operations.

Technical Contribution

The paper presents a novel heuristic algorithm for tracing cross-chain transactions between EVM-compatible blockchains, achieving high matching rates for deposits while revealing lower effectiveness for withdrawals.

Novelty

This work introduces a unique approach to tracking cross-chain transactions by exploiting consistent user addresses across EVM-compatible blockchains, providing insights into temporal asymmetries and security vulnerabilities in cross-chain operations.

Limitations

- The matching algorithm's effectiveness is constrained by data completeness limitations, particularly on the Polygon side, and time tolerance constraints.

- Withdrawal transactions are more complex and difficult to distinguish from regular token transfers, leading to lower match rates compared to deposits.

- The analysis focuses specifically on the Polygon PoS Bridge, which may not generalize to other cross-chain bridge implementations or blockchain pairs.

Future Work

- Extend the methodology to non-EVM-based blockchains with necessary adaptations, especially addressing the challenge of different address generation systems.

- Investigate governance-related risks in cross-chain transactions, such as potential transaction censorship and extended confirmation windows exposing users to security vulnerabilities.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSafeguarding Blockchain Ecosystem: Understanding and Detecting Attack Transactions on Cross-chain Bridges

Dan Lin, Jiajing Wu, Jianzhong Su et al.

zkBridge: Trustless Cross-chain Bridges Made Practical

Dawn Song, Fan Zhang, Jiaheng Zhang et al.

XChainWatcher: Monitoring and Identifying Attacks in Cross-Chain Bridges

Miguel Correia, André Augusto, Rafael Belchior et al.

No citations found for this paper.

Comments (0)