Summary

We analyze the errors arising from discrete readjustment of the hedging portfolio when hedging options in exponential Levy models, and establish the rate at which the expected squared error goes to zero when the readjustment frequency increases. We compare the quadratic hedging strategy with the common market practice of delta hedging, and show that for discontinuous option pay-offs the latter strategy may suffer from very large discretization errors. For options with discontinuous pay-offs, the convergence rate depends on the underlying Levy process, and we give an explicit relation between the rate and the Blumenthal-Getoor index of the process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

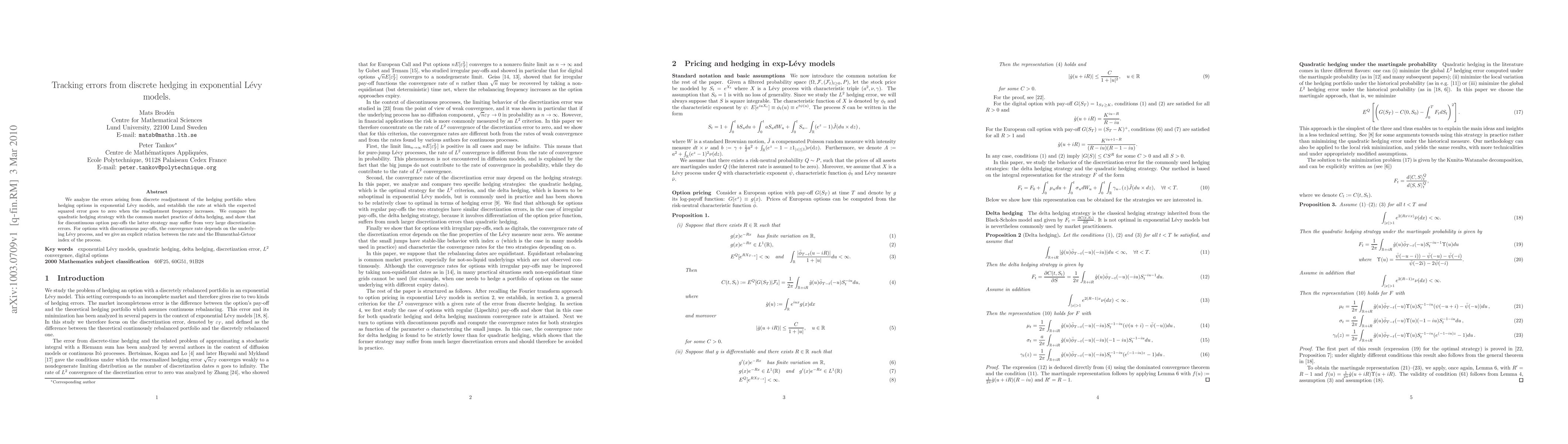

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)