Authors

Summary

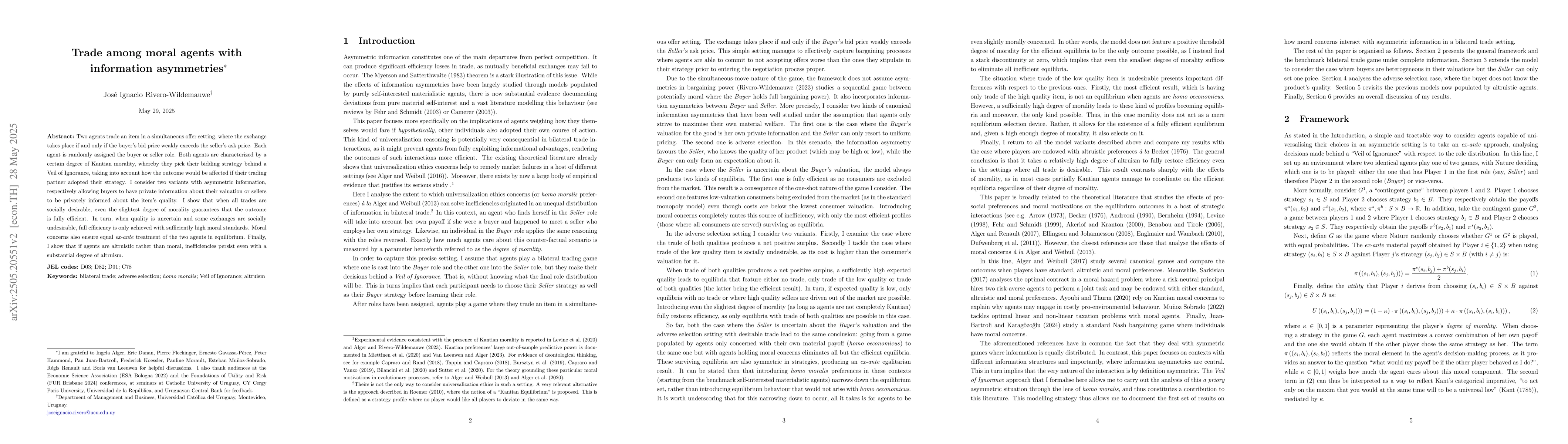

Two agents trade an item in a simultaneous offer setting, where the exchange takes place if and only if the buyer's bid price weakly exceeds the seller's ask price. Each agent is randomly assigned the buyer or seller role. Both agents are characterized by a certain degree of Kantian morality, whereby they pick their bidding strategy behind a Veil of Ignorance, taking into account how the outcome would be affected if their trading partner adopted their strategy. I consider two variants with asymmetric information, respectively allowing buyers to have private information about their valuation or sellers to be privately informed about the item's quality. I show that when all trades are socially desirable, even the slightest degree of morality guarantees that the outcome is fully efficient. In turn, when quality is uncertain and some exchanges are socially undesirable, full efficiency is only achieved with sufficiently high moral standards. Moral concerns also ensure equal ex-ante treatment of the two agents in equilibrium. Finally, I show that if agents are altruistic rather than moral, inefficiencies persist even with a substantial degree of altruism.

AI Key Findings

Generated Jun 07, 2025

Methodology

The research employs a simultaneous offer setting for trade between two agents, where roles (buyer or seller) are randomly assigned. Agents choose bidding strategies considering their partner's potential strategy under a Veil of Ignorance, incorporating Kantian morality.

Key Results

- Even slight moral inclination ensures efficient outcomes when all trades are socially desirable.

- High moral standards are necessary for full efficiency when some exchanges are socially undesirable and quality is uncertain.

- Moral agents ensure equal ex-ante treatment in equilibrium.

Significance

This research highlights the role of moral agents in achieving efficient and equitable trade outcomes, contrasting altruistic behavior that may still result in inefficiencies.

Technical Contribution

The paper introduces a model incorporating Kantian morality into trade theory with information asymmetries, demonstrating its effects on efficiency and equity.

Novelty

Distinct from existing research by focusing on the role of moral agents in overcoming inefficiencies caused by information asymmetries, contrasting it with altruistic behavior.

Limitations

- Findings are specific to a simultaneous offer setting with two agents.

- Assumes agents' rationality and ability to consider counterfactual scenarios under the Veil of Ignorance.

Future Work

- Explore trade dynamics with more than two agents and different information structures.

- Investigate the impact of varying degrees of moral inclination on trade outcomes.

Paper Details

PDF Preview

Similar Papers

Found 4 papersMoral Alignment for LLM Agents

Mirco Musolesi, Stephen Hailes, Elizaveta Tennant

The prevalence of moral distress and moral injury among U.S. veterans.

Litz, Brett T, Walker, Hannah E, Pietrzak, Robert H et al.

No citations found for this paper.

Comments (0)