Summary

Alpha signals for statistical arbitrage strategies are often driven by latent factors. This paper analyses how to optimally trade with latent factors that cause prices to jump and diffuse. Moreover, we account for the effect of the trader's actions on quoted prices and the prices they receive from trading. Under fairly general assumptions, we demonstrate how the trader can learn the posterior distribution over the latent states, and explicitly solve the latent optimal trading problem. We provide a verification theorem, and a methodology for calibrating the model by deriving a variation of the expectation-maximization algorithm. To illustrate the efficacy of the optimal strategy, we demonstrate its performance through simulations and compare it to strategies which ignore learning in the latent factors. We also provide calibration results for a particular model using Intel Corporation stock as an example.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

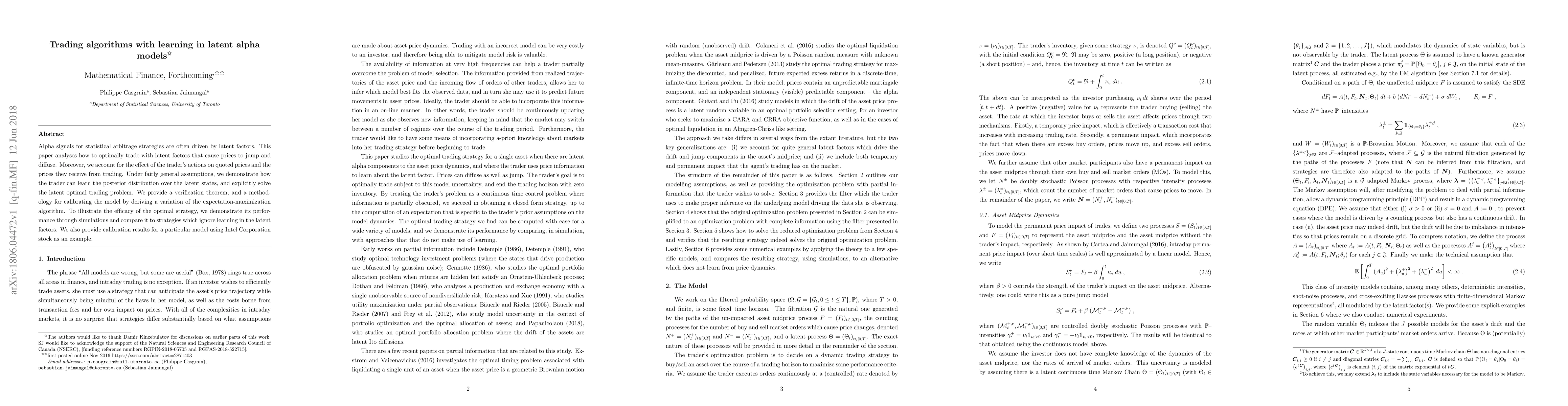

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)