Authors

Summary

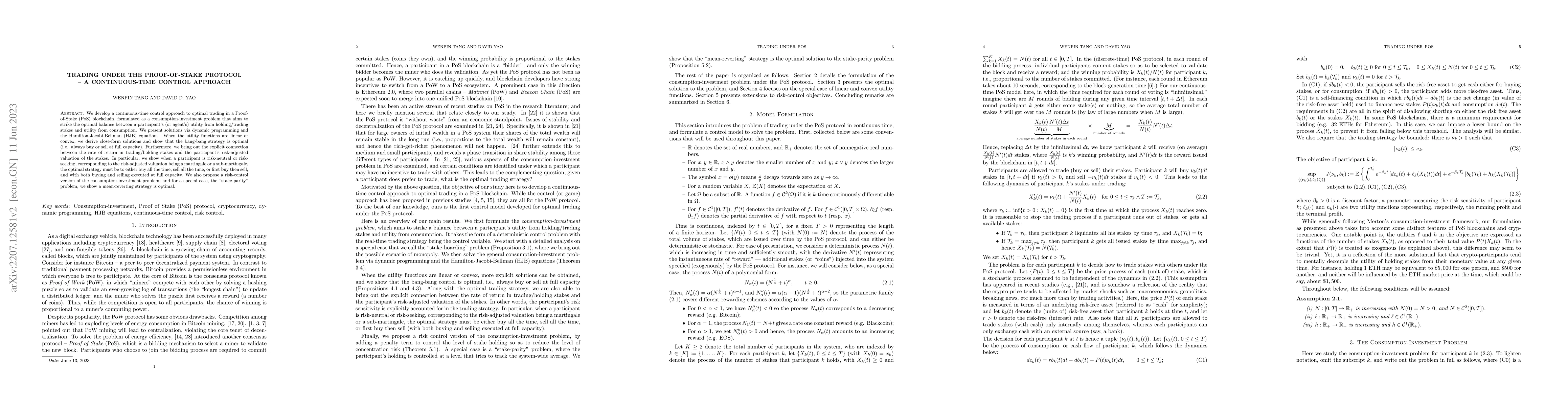

We develop a continuous-time control approach to optimal trading in a Proof-of-Stake (PoS) blockchain, formulated as a consumption-investment problem that aims to strike the optimal balance between a participant's (or agent's) utility from holding/trading stakes and utility from consumption. We present solutions via dynamic programming and the Hamilton-Jacobi-Bellman (HJB) equations. When the utility functions are linear or convex, we derive close-form solutions and show that the bang-bang strategy is optimal (i.e., always buy or sell at full capacity). Furthermore, we bring out the explicit connection between the rate of return in trading/holding stakes and the participant's risk-adjusted valuation of the stakes. In particular, we show when a participant is risk-neutral or risk-seeking, corresponding to the risk-adjusted valuation being a martingale or a sub-martingale, the optimal strategy must be to either buy all the time, sell all the time, or first buy then sell, and with both buying and selling executed at full capacity. We also propose a risk-control version of the consumption-investment problem; and for a special case, the ''stake-parity'' problem, we show a mean-reverting strategy is optimal.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEthereum Proof-of-Stake under Scrutiny

Sara Tucci-Piergiovanni, Ulysse Pavloff, Yackolley Amoussou-Guenou

| Title | Authors | Year | Actions |

|---|

Comments (0)