Summary

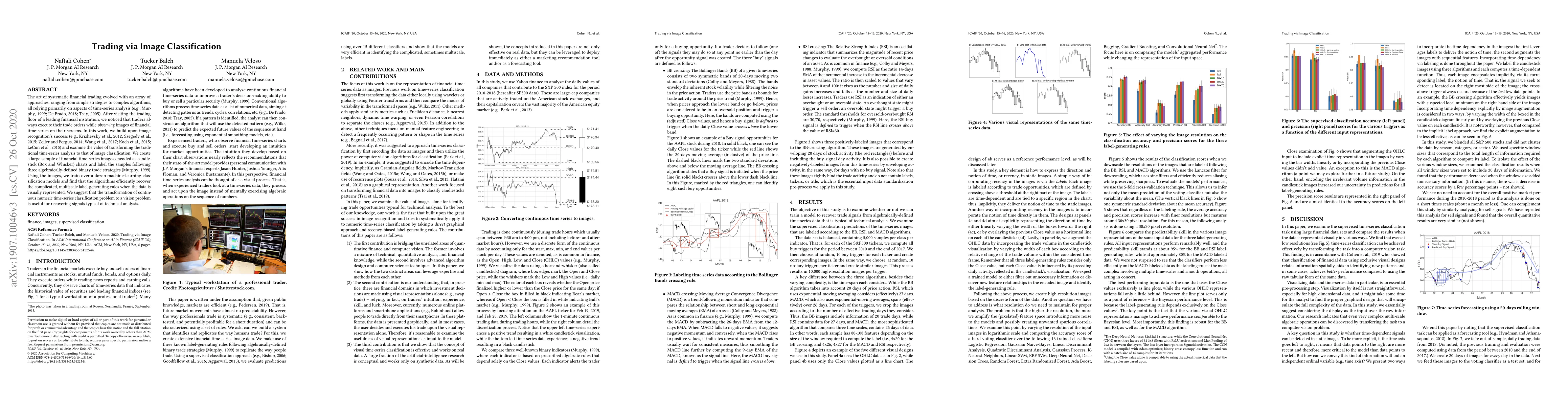

The art of systematic financial trading evolved with an array of approaches, ranging from simple strategies to complex algorithms all relying, primary, on aspects of time-series analysis. Recently, after visiting the trading floor of a leading financial institution, we noticed that traders always execute their trade orders while observing images of financial time-series on their screens. In this work, we built upon the success in image recognition and examine the value in transforming the traditional time-series analysis to that of image classification. We create a large sample of financial time-series images encoded as candlestick (Box and Whisker) charts and label the samples following three algebraically-defined binary trade strategies. Using the images, we train over a dozen machine-learning classification models and find that the algorithms are very efficient in recovering the complicated, multiscale label-generating rules when the data is represented visually. We suggest that the transformation of continuous numeric time-series classification problem to a vision problem is useful for recovering signals typical of technical analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)