Summary

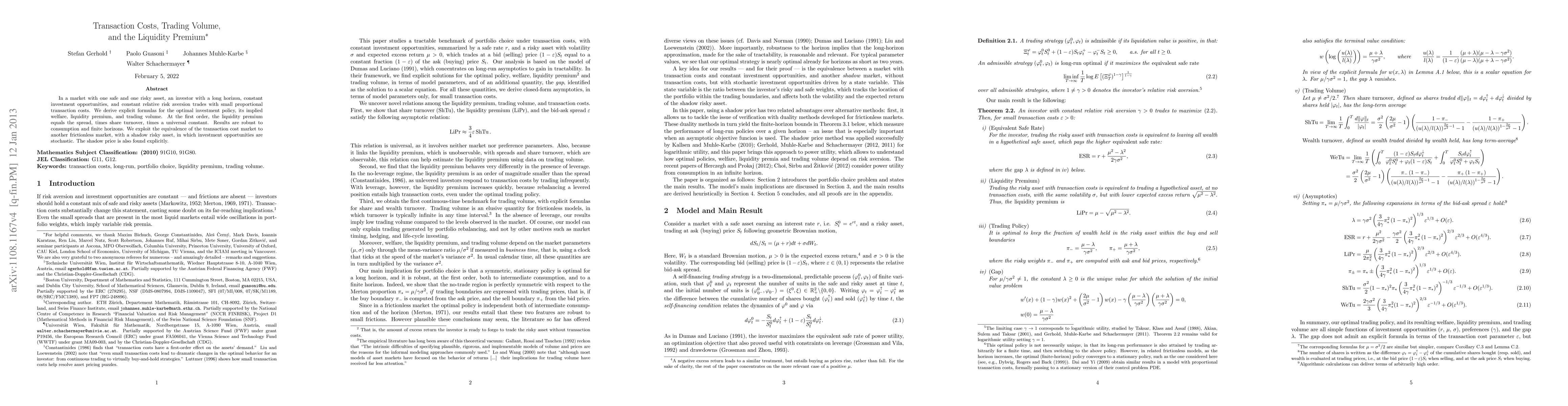

In a market with one safe and one risky asset, an investor with a long horizon, constant investment opportunities, and constant relative risk aversion trades with small proportional transaction costs. We derive explicit formulas for the optimal investment policy, its implied welfare, liquidity premium, and trading volume. At the first order, the liquidity premium equals the spread, times share turnover, times a universal constant. Results are robust to consumption and finite horizons. We exploit the equivalence of the transaction cost market to another frictionless market, with a shadow risky asset, in which investment opportunities are stochastic. The shadow price is also found explicitly.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLiquidity Premium, Liquidity-Adjusted Return and Volatility, and Extreme Liquidity

Qi Deng, Zhong-guo Zhou

| Title | Authors | Year | Actions |

|---|

Comments (0)