Summary

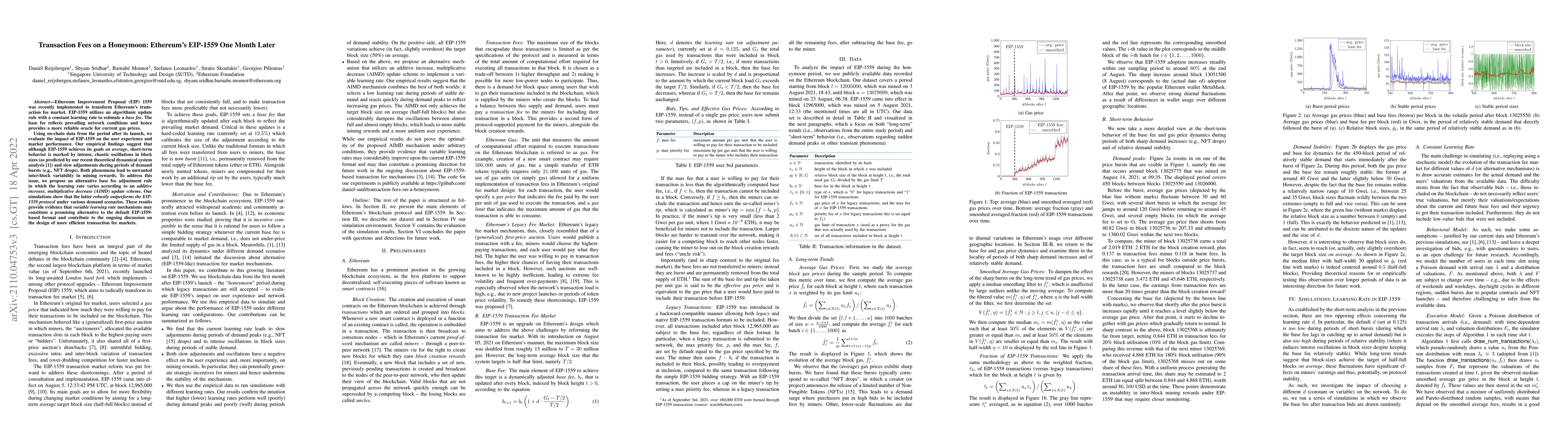

Ethereum Improvement Proposal (EIP) 1559 was recently implemented to transform Ethereum's transaction fee market. EIP-1559 utilizes an algorithmic update rule with a constant learning rate to estimate a base fee. The base fee reflects prevailing network conditions and hence provides a more reliable oracle for current gas prices. Using on-chain data from the period after its launch, we evaluate the impact of EIP-1559 on the user experience and market performance. Our empirical findings suggest that although EIP-1559 achieves its goals on average, short-term behavior is marked by intense, chaotic oscillations in block sizes (as predicted by our recent theoretical dynamical system analysis [1]) and slow adjustments during periods of demand bursts (e.g., NFT drops). Both phenomena lead to unwanted inter-block variability in mining rewards. To address this issue, we propose an alternative base fee adjustment rule in which the learning rate varies according to an additive increase, multiplicative decrease (AIMD) update scheme. Our simulations show that the latter robustly outperforms the EIP-1559 protocol under various demand scenarios. These results provide evidence that variable learning rate mechanisms may constitute a promising alternative to the default EIP-1559-based format and contribute to the ongoing discussion on the design of more efficient transaction fee markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEmpirical Analysis of EIP-1559: Transaction Fees, Waiting Time, and Consensus Security

Yuxuan Lu, Fan Zhang, Yulin Liu et al.

Base Fee Manipulation In Ethereum's EIP-1559 Transaction Fee Mechanism

Lioba Heimbach, Alexander Hicks, Sarah Azouvi et al.

Unraveling Ethereum's Mempool: The Impact of Fee Fairness, Transaction Prioritization, and Consensus Efficiency

S M Mostaq Hossain, Amani Altarawneh

| Title | Authors | Year | Actions |

|---|

Comments (0)